What to do if Your Brakes Fail on the Road

If you’ve never experienced a brake failure, the thought of one happening likely doesn’t cross your...

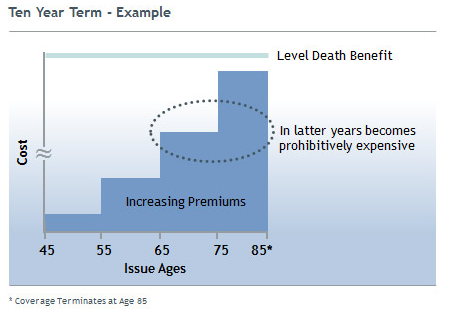

Initially, term life insurance is an inexpensive option. It is often used to cover temporary debt such as mortgage and other shorter term issues. Term insurance prices increase dramatically with age. Owners of these policies can expect to experience an increase at each term renewal. There are a variety of these term options available.

If you looking for any of the following items, you may be best suited for a term life insurance policy.

When selecting a term product you should consider the time frame that you will need the coverage, and take into account when the following events will take place:

If someone will suffer financially when you die, you need life insurance. It provides money to your family after your death. A life insurance policy will replaces your income and can help your family meet important financial needs.

Read more

Great experience. Called in, didn't have to wait, and spoke to a human very quickly. In addition, the process of getting a CGL insurance quote was quick and painless. Travis was knowledgeable and I would highly recommend.

If you’ve never experienced a brake failure, the thought of one happening likely doesn’t cross your...