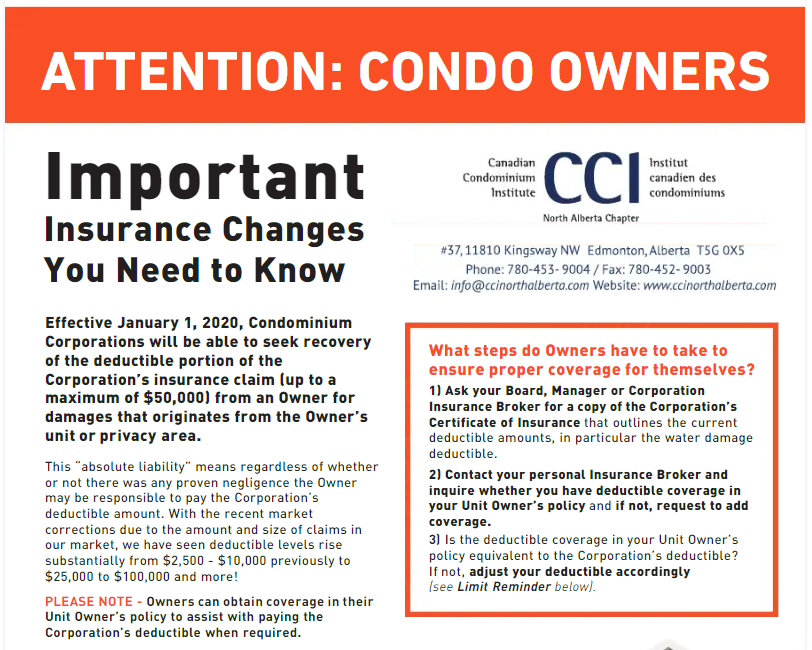

The Canadian Condominium Institute has announced changes to the Condominium Property Regulations that may leave condo unit owners holding a bill for up to $50,000. The changes that took effect on January 1, 2020 will allow condo corporations to seek recovery of insurance deductibles from an owner for damages that originate from the owner's unit.

What this Means for Condo Unit Owners

"Unit owners will be responsible for the deductible portion of any insured loss that originates in their unit or privacy area" stated Todd Shipley, of Reynolds Mirth Richards & Farmer LLP at a recent Canadian Condominium Institute event. He went on the confirm that this does not require fault on the unit owners part. Your condo corporation can seek to recover their deductible from you if the damage originated in your unit or privacy area

Responsibility for this used to be dictated by your condo bylaws. This is a change in the regulations that over rules what the your specific condo bylaws state.

What Can You Do

It is important to ensure that your condo insurance policy covers this up to $50,000. Many condo insurance policies already have coverage in place for this. Different companies call the coverage different things, but it is usually called either "loss assessment", "property loss assessment coverage" or "common elements loss assessment". Some of you may already have $50,000 of coverage in this area, but some will need more coverage here.

We are working with our companies to have this coverage added and will be doing our best to contact customers who need more coverage here. If you are unsure if you have enough coverage in this area, please call your insurance broker as soon as possible to ensure that you are protected.