A question that I get asked from time to time is: The money that is paid out in an insurance claim, is that taxable? This creates an interesting question about what is considered income. In order to answer this question, we wanted to look at a few scenarios.

3 min read

Are Insurance Claims Taxable in Canada?

By Jake McCoy on Jan 30, 2025 12:10:25 PM

Topics: Insurance Claim claim

2 min read

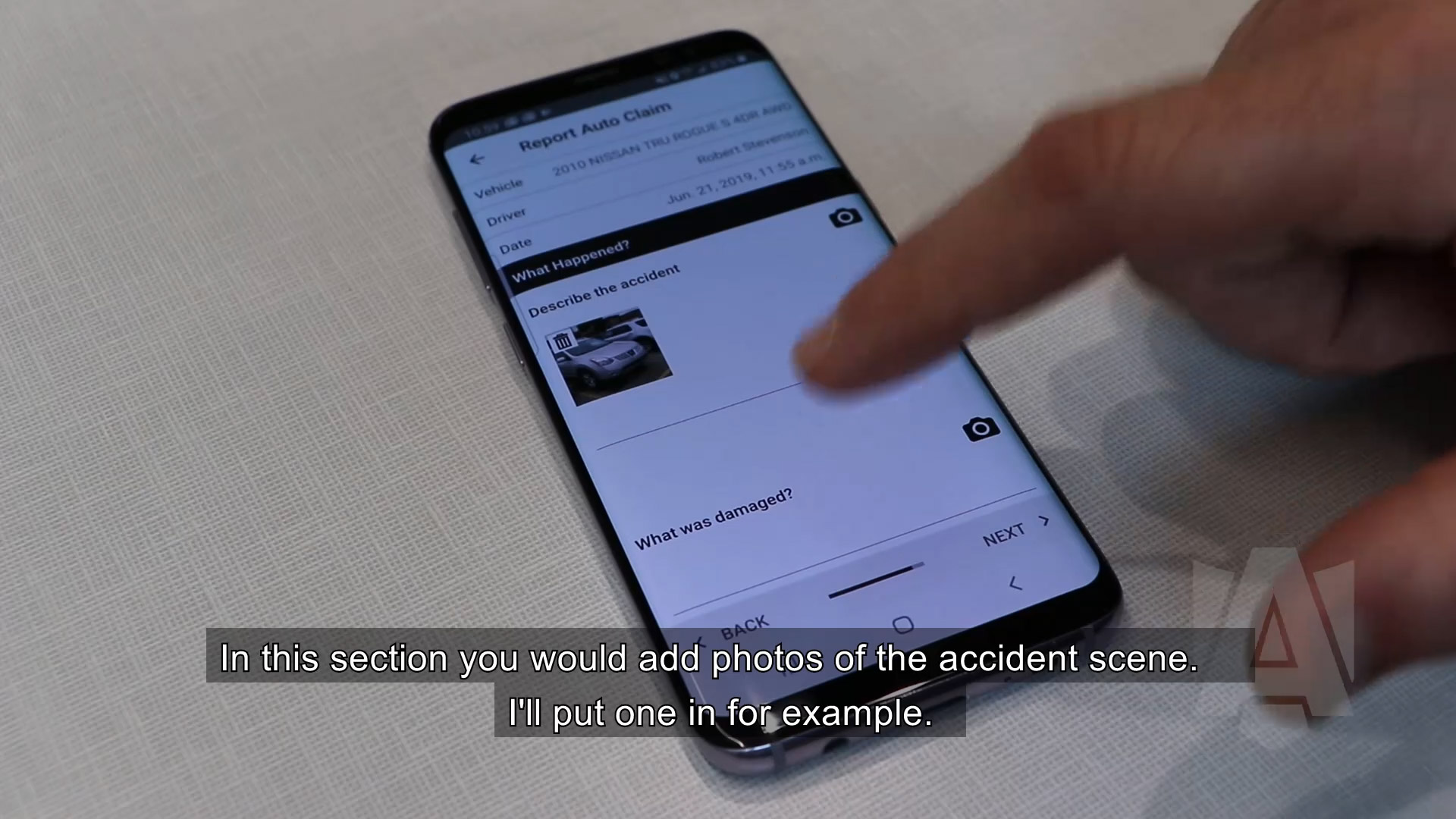

How to Report An Auto Claim on Your Armour Mobile App

By Rob Stevenson on Jul 5, 2019 12:25:00 PM

If you've ever been involved in a collision, you know that no matter how minor, it leaves you shaken. This makes recording all of the information that you need that much harder. Armour makes this process a little bit easier with the Armour Mobile App and our guided claims process.

Topics: Auto Insurance Insurance Claims Insurance Claim

2 min read

Common Mistakes you Don’t Want to Make When Filing Your First Claim

By Rob Stevenson on Jan 25, 2016 10:58:38 AM

The most significant insurance mistake you can ever make is not having any insurance at all. For example, if you drive without auto insurance you are breaking the law. If you get homeowners insurance when you purchase your house and then cancel it, you would be in quite the predicament if a fire destroys your kitchen.

Topics: Car Insurance home insurance Insurance Claims Insurance Claim

1 min read

Is Your Home Covered While You're Renovating?

By Rob Stevenson on Jan 7, 2014 8:47:00 AM

Topics: insurance edmonton home insurance Sewer Back up Insurance Claims Insurance Claim house insurance tips

1 min read

Wawanesa Insurance Releases Online Insurance Claims

By Rob Stevenson on Oct 8, 2013 4:04:00 PM

In a statement released to brokers this afternoon Wawanesa Insurance announced that they have released a new option for reporting car insurance and home insurnace claims online.

In a statement released to brokers this afternoon Wawanesa Insurance announced that they have released a new option for reporting car insurance and home insurnace claims online.

Topics: Car Insurance home insurance Insurance Claims Insurance Claim claim

2 min read

Returning Home After a Disaster

By Rob Stevenson on Jul 30, 2013 2:50:00 PM

After a disaster strikes, returning to your home can be an emotional experience. Unfortunately, if you’re not careful, it can also be a dangerous one. The disaster may have caused damages to your home that now present a safety hazard to you and your family. It is important that you properly inspect your home for potential hazards before you resume your life there.

After a disaster strikes, returning to your home can be an emotional experience. Unfortunately, if you’re not careful, it can also be a dangerous one. The disaster may have caused damages to your home that now present a safety hazard to you and your family. It is important that you properly inspect your home for potential hazards before you resume your life there.

Hazards to Look For

- Natural gas. If you smell gas or hear a hissing sound, open a window and leave immediately. Alert the gas company as soon as possible. Do not smoke or make use of any other items that have an open flame inside a damage house unless you are sure there are no gas leaks or other flammable materials present.

- Sparks and broken or frayed wires. Use a flashlight when first entering your home if you are unsure of the condition of your electrical system. Do not turn on any lights until you are sure they are safe to use. If you suspect damage to any part of your electrical system or if there is standing water in your home, turn off the electricity at the main fuse box if you can safely do so.

- Roof, foundation and chimney cracks. A close examination of your home’s structural integrity is very important. If you feel that there is a chance for collapse, leave immediately.

- Appliances. If appliances are wet or appear to be damaged, turn off the electricity running to them at the main fuse box and then unplug them. Check that they, and your electrical system, work properly before plugging them back in.

- Water and sewage systems. If any pipes are damaged turn off your water at the main valve. Check with local authorities before using any water for cooking or cleaning as it may be contaminated. If you are supplied by your own well have a sample tested before use. Also, make sure sewer lines are intact before using toilers.

- Food and other supplies. Throw out all food and other perishable items that may have been contaminated. This is especially important when goods have come into contact with standing water.

- Clean up hazardous materials. Household chemicals, raw sewage and other hazardous substances that have spilled or leaked throughout your home need to be cleaned up as soon as possible. Make sure you take the proper care to protect yourself from the substance during this process.

- Call your insurance agent. Take pictures of damages before you begin cleanup and keep good records of repair and cleaning costs.

Topics: Insurance Claims Insurance Claim Catastrophes flood disaster

2 min read

Alberta Summer Storm Activity - Property Insurance

By Bill Reay on Oct 10, 2012 12:09:00 PM

Connect with Bill on Google+

Topics: insurance edmonton home insurance property insurance Insurance Claims Insurance Claim Homeowners

2 min read

Are you a helmet wearer? - Home Insurance Edmonton

By Bill Reay on Jun 11, 2012 11:47:00 AM

Purchasing home and life insurance is a no-brainer. But what about taking the proper precautions to ensure that you hopefully won't need to make claims? The weather is right for cycling - are you wearing your helmet?

Topics: life insurance home insurance Insurance Claim edmonton car insurance collision

1 min read

Home Insurance Water Damage iPad App released today

By Rob Marusin on Mar 20, 2012 9:27:00 PM

The Insurance Bureau of Canada (IBC) launched the Dry House Challenge iPad app to help Canadians learn how to prevent water damage to their properties.

Topics: Insurance Claim

1 min read

Actual Cash Value vs. Replacement Cost

By Rob Marusin on Feb 22, 2012 9:54:00 AM

At Armour Insurance we work with you to try and obtain insurance that will provide payment based on the replacement cost of damaged or stolen property. A Replacement Cost Policy compensates you for the actual cost of replacing your property. If your golf clubs are stolen, a replacement cost policy will reimburse you the full cost of replacing it with new golf clubs of like kind and quality without taking into consideration the fact that your clubs are four years old. In other words your settlement is not depreciated when you have replacement cost.