Losing someone you care about is hard enough on its own. In the days that follow, there are often practical tasks to manage that feel unfamiliar and overwhelming. Dealing with insurance is one of those responsibilities, and it can feel especially heavy when you are already grieving. If you are trying to cancel insurance for a deceased person, the process often feels confusing or frustrating.

5 min read

How to Cancel Insurance for a Deceased Person: A Step-by-Step Guide

By Jake McCoy on Jan 24, 2026 11:14:59 AM

Topics: Insurance Cancellation

16 min read

Alberta Auto Insurance Sees 20% Grid Base Premium Increase in 2026

By Jake McCoy on Jan 9, 2026 9:15:01 AM

Starting January 1, 2026, auto insurance Grid base premiums in Alberta increased by 20% compared to January 2025. This adjustment was issued by the Alberta Automobile Insurance Rate Board on September 26, 2025. Alberta's Grid system for auto insurance can be complicated. To make things as clear as possible, we'll explain what Grid is, who is on the Grid, and how Grid has changed over time in the province.

Topics: Auto Insurance Grid Rating Insurance Grid Rating

2 min read

3 min read

Is it Ever Legal to Do a U-Turn in Alberta?

By Rob Stevenson on Sep 4, 2025 11:45:00 AM

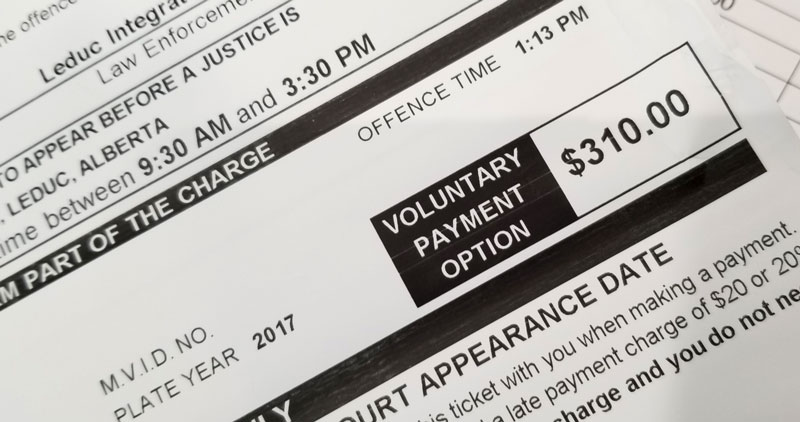

On a sunny Saturday morning last May I was pulled over and issued a ticket for an illegal U-Turn. After I got past the initial embarrassment of being pulled over on a busy road, I asked the police officer, where it actually WAS legal to make a U-turn in Alberta. His response surprised me...

Topics: Car Insurance traffic laws

15 min read

Alberta Auto Insurance in Crisis: 3 Shocking Facts From 2025 AAIRB Report

By Jake McCoy on Aug 26, 2025 2:00:00 PM

On June 11, 2025, the Alberta Auto Insurance Rate Board (AAIRB) released its 2025 Annual Review of Industry Experience. This 231-page document is a detailed look at the current state of Alberta’s auto insurance market. While most people are unlikely to sit down and read the entire report, the data contains surprising and, in some cases, alarming insights about how the industry is performing, how premiums are trending, and what that means for drivers. After reviewing the numbers in detail, we found three facts that may change how you think about auto insurance in Alberta.

Topics: Auto Insurance Car Insurance Alberta Car Insurance Reform

4 min read

Voluntary Payments Coverage: Understanding Your Home Insurance

By Jake McCoy on Aug 8, 2025 10:58:47 AM

When most people think about home insurance, they picture protection for major events like fire, theft, or flooding. But many home insurance policies also include additional coverages that are often overlooked. Two of the most helpful are Voluntary Medical Payments and Voluntary Property Damage.

Topics: home insurance property insurance

4 min read

Additional Living Expenses: Understanding your Home Insurance

By Jake McCoy on Jul 24, 2025 8:30:00 AM

No one expects to be forced out of their home. But disasters like fires, floods, or windstorms can leave your property temporarily uninhabitable. In these moments, the last thing you want to worry about is where you will stay or how you will afford to maintain your standard of living. That is where Additional Living Expenses, often called ALE, come into play. This important part of your property insurance policy helps ease the financial burden when life is disrupted by a covered claim.

Topics: home insurance property insurance Additional Living Expenses

4 min read

Sewer Backup Coverage: Understanding Your Home Insurance

By Jake McCoy on Jul 23, 2025 10:15:00 AM

When it comes to home insurance, most homeowners think about fire, theft, or hail damage, but what about what’s happening underground? Sewer backups are one of the messiest and most expensive types of water damage. Without the right coverage in place, you could be left footing a hefty bill and dealing with a health hazard in your own home.

Topics: home insurance Sewer Back up

2 min read

True or False? You should always fill your gas tank full rather than adding $10 - $20 at a time.

By Rob Stevenson on Jun 25, 2025 11:15:00 AM

We've all had this experience one time or another: you're late for an appointment and realize that your gas tank is running on empty, rather than taking the time to fill it up you just put enough to hold you over. For some of us this is more than just a rare occurrence, for some, this happens every time we visit the gas station.

So, are we saving more than just time when we only fill the tank part way or is it better to always fill your gas tank full each time we visit the pump?

Topics: Car Insurance Edmonton filling up gas savings

5 min read

Getting a Home Insurance Quote Doesn’t Have to Be a Pain

By Jake McCoy on Jun 17, 2025 7:45:00 AM

Let’s be honest. Getting a home insurance quote doesn’t top anyone’s list of fun things to do. A lot of people assume it’s a long, frustrating process filled with obscure questions and time-consuming forms. While it used to be that way, modern quoting tools and smart data systems have changed the game.

The truth? It’s probably easier than you think. If you’re working with a brokerage like Armour Insurance, we’ll do most of the heavy lifting for you. Let’s walk through how quoting works, why certain questions matter, and how we make it as smooth and painless as possible.

Topics: home insurance property insurance

9 min read

Driving Convictions in Alberta: How They Impact Your Insurance

By Jake McCoy on Jun 13, 2025 2:57:59 PM

Driving convictions can have a significant impact on your auto insurance premium and driving record. It is important to understand what constitutes a driving conviction and the different infractions on the road. In this article, we will explore the various types of driving convictions in Alberta, from minor to major infractions, criminal code convictions, and what they ultimately could end up costing you on your insurance.

Topics: Auto Insurance Car Insurance Edmonton Auto Insurance Edmonton Defensive Driving

4 min read

Parking Coverage: What Does It Cover?

By Jake McCoy on Jun 13, 2025 2:53:53 PM

When it comes to car insurance, most people are familiar with comprehensive and collision coverage to protect their vehicles while driving. What about times when your car is not on the road? Whether you're taking an extended vacation, working remotely, or simply not using your vehicle for a while, parking coverage can offer financial protection and peace of mind.

Topics: Car Insurance Quote Auto Insurance Car Insurance

3 min read

Someone Broke My Car Mirror, Here's What I did

By Jake McCoy on May 21, 2025 10:00:00 AM

After spending a wonderful Sunday out with my friends, I came back to my apartment around 8:30PM and parked my car on the street, just as I had done several times before without issue. After a restful nights sleep, I got up the next morning to less than pleasant surprise. Someone had kicked out my cars mirrors.

Topics: car thieves Car Insurance car accident car safety

4 min read

Before the Smoke Rises: 10 Must-Haves for Your Fire Evacuation Kit

By Jake McCoy on May 7, 2025 11:55:00 AM

When wildfires strike, you may only have minutes to act. That’s why it’s so important to be prepared before there’s ever smoke on the horizon. Whether you live in a high-risk wildfire zone or simply want to be ready for the unexpected, this guide answers some of the most common fire evacuation questions and gives you a clear list of what to pack in your emergency go-bag.

Topics: home insurance fire safety

4 min read

Best Places to go Boating in Alberta

By Gina Schopfer on May 1, 2025 11:45:00 AM

Ahhh... the lake! Now that summer's just around the corner (one might even say it's here already), lots of Alberta families are gearing up to take their boats out. And really, is there anything better than being stuck out on the water with your loved ones?

Topics: Boat Insurance Summer Insurance Guide Alberta Boating

4 min read

Risk Revealed: Alberta's Top 10 High-Theft Vehicles

By Jake McCoy on May 1, 2025 4:15:00 AM

The top 10 most commonly stolen vehicles in Alberta have been released by Canadian company Équité. We wanted to do an in-depth look at vehicle theft frequency rather than sheer numbers. In essence, we wanted to answer the question, what type of vehicle is most likely to be stolen if you were going to purchase one? The following numbers are based on the rate at which a specific vehicle is stolen proportional to the number of vehicles on the road.

Topics: car thieves Car Insurance theft insurance

4 min read

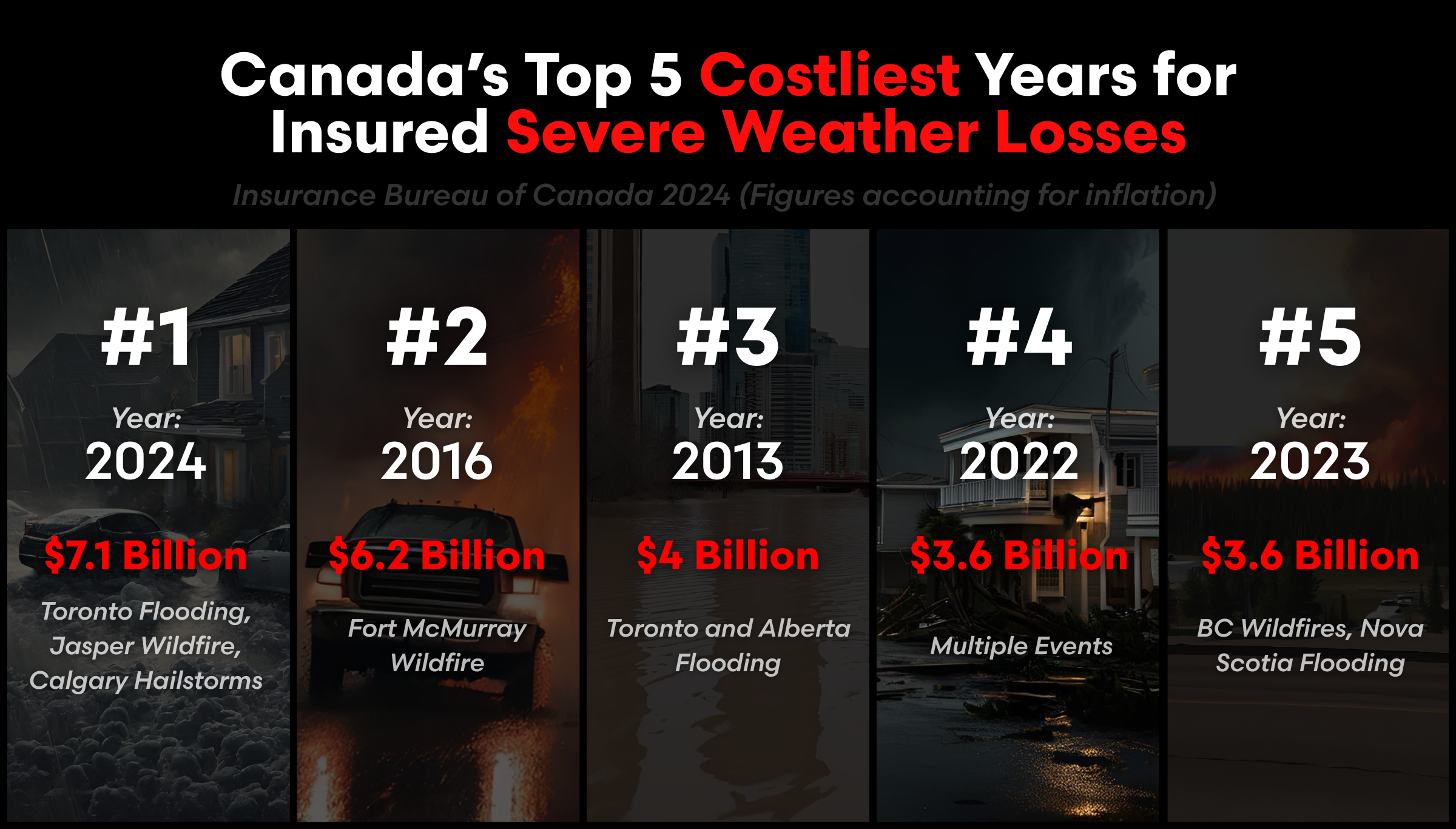

The $7B Impact of Canada’s 2024 Severe Weather Events

By Jake McCoy on Apr 30, 2025 10:30:00 AM

The summer of 2024 has gone down as the most expensive season for insured severe weather losses in Canadian history. With devastating floods, wildfires, and hailstorms, it served as a harsh wake-up call about the growing toll of climate-fueled disasters. For Alberta and the rest of the country, this isn’t just a seasonal anomaly, it’s a signal that the severe weather landscape is changing, fast.

Topics: Insurance Claims Climate Change

2 min read

What Happens if you get Caught Without Valid Registration on your Car?

By Rob Stevenson on Mar 27, 2025 8:15:00 AM

Have you ever been pulled over without valid registration on your vehicle? Is your registration up to date? I was caught on Highway 2 last weekend with expired registration on my car. Here's what happened.

Topics: registration vehicle registration Alberta registry traffic laws Armour Registry

3 min read

Scheduling Assets on Your Home Insurance Policy

By Jake McCoy on Mar 24, 2025 12:00:00 PM

Home and tenant insurance policies have a designated amount of money that they will compensate in the event of a total loss. Scheduling an asset on your insurance is specifically naming that item or collection and having a value assigned to it that would be compensated if there was a total loss.

Topics: home insurance Tenants Insurance

5 min read

10 Things You Might Want to Name On Your Property Insurance Policy

By Jake McCoy on Mar 24, 2025 8:30:00 AM

Whether you live in a condo, a house, or you’re renting the place you call home, your property insurance is an important part of your financial stability. Regardless of whether you own the place you call home; an important part of your property insurance is ensuring you have adequate coverage for the contents.

Topics: home insurance property insurance Tenants Insurance

3 min read

Contents Coverage: Understanding Your Home Insurance

By Jake McCoy on Mar 21, 2025 9:30:00 AM

Your home is more than just four walls, it’s filled with the possessions that make it uniquely yours. From furniture and electronics to clothing and collectibles, these belongings hold both financial and sentimental value. That’s where contents insurance, also known as personal property coverage, comes in. It helps protect your possessions in case of unexpected events like theft, fire, or water damage.

Topics: home insurance property insurance

3 min read

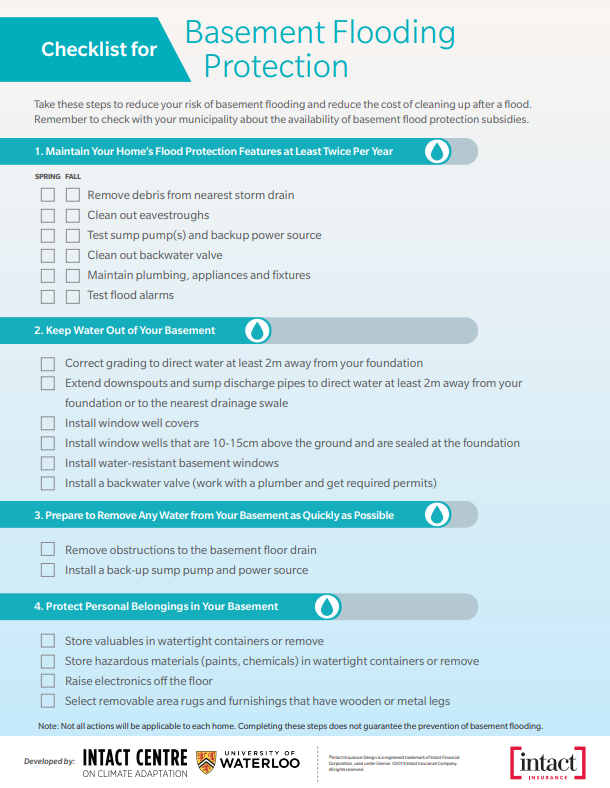

Does My House Have a Sump Pump and/or Backwater Valve?

By Jake McCoy on Mar 20, 2025 6:15:00 PM

Ensuring your home is equipped with essential flood prevention devices like a sump pump and backwater valve can be crucial for protecting your property. In this guide, we'll explain what these devices are, how they work, and how to locate them in your home.

Topics: home insurance Basement Flooding

4 min read

The Guide to Auto Insurance In Alberta: Liability, Comprehensive, and Collision

By Jake McCoy on Mar 11, 2025 10:15:00 AM

Auto insurance is a necessary expense for any vehicle owner. It protects you financially in the event of an accident, theft, or damage to your car. Three levels of coverage are offered to protect your automobile: liability, comprehensive, and collision. Each type of coverage provides different coverages for your vehicle, and it's important to understand the difference between them.

2 min read

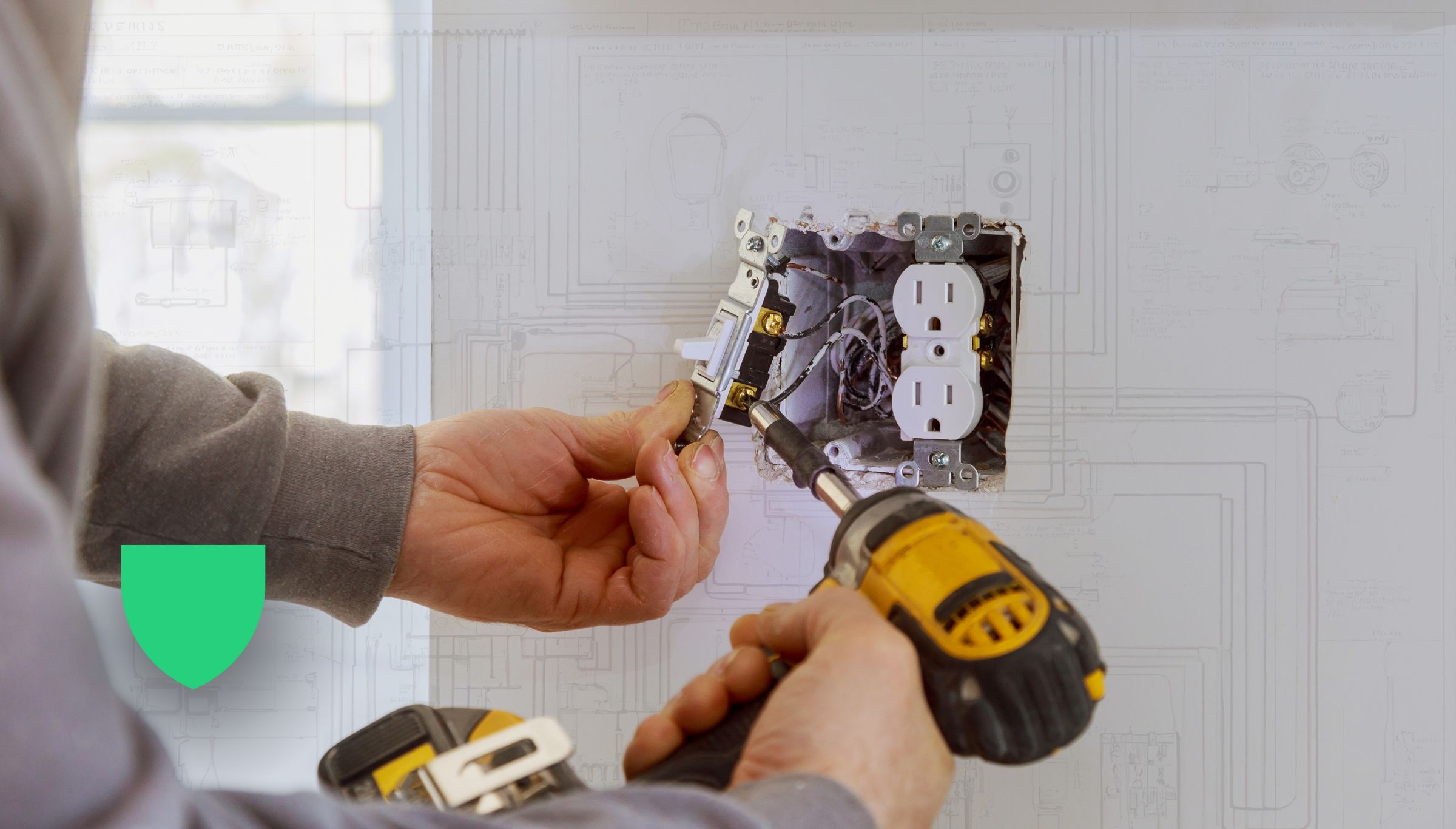

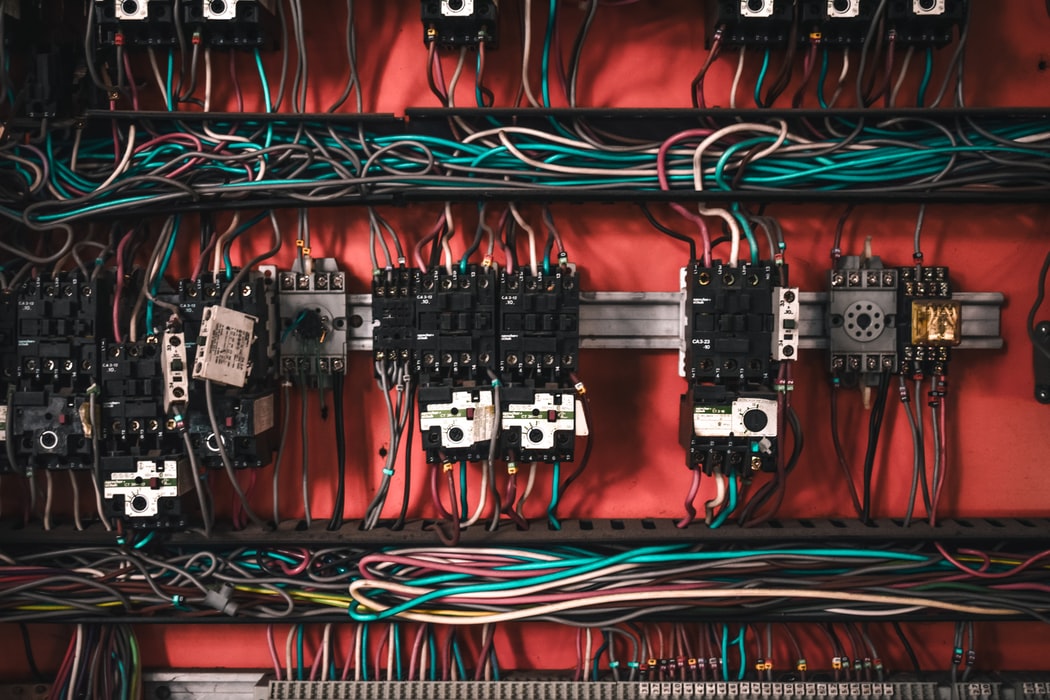

How Do I know What Kind Of Wiring My Home Has?

By Jake McCoy on Mar 11, 2025 1:00:00 AM

Knowing the type of wiring in your home is crucial for safety and insurance purposes. Different types of wiring have different risks associated with them, and understanding what you have can help you make informed decisions about maintenance and coverage. In Canada, homes can have various types of wiring, including aluminum, copper, and knob-and-tube. Here's a simple guide to help you identify what kind of wiring your home uses.

Topics: home insurance property insurance

5 min read

What Does My Property Liability Insurance Cover?

By Jake McCoy on Mar 5, 2025 9:45:00 AM

When you own or rent the place you call home, it is incredibly important to get property insurance. In some cases, you're legally required to have insurance to be able to get a mortgage or sign a lease. Even if you're not technically required to have a property insurance policy, it's still in your best interest to get property insurance that at the very least gives you liability protection.

Topics: property insurance liability third party liability

4 min read

Auto Liability Insurance: What Is It And How Much Do I Need?

By Jake McCoy on Mar 4, 2025 8:30:00 AM

As a driver, it's important to have insurance to protect yourself and others in case of an accident. In Alberta, the legal minimum car insurance is third party liability coverage. In this article, we'll cover what auto liability insurance is, what it covers, whether it's enough, and how much liability insurance you need.

Topics: Auto Insurance Car Insurance Car Insurance Edmonton edmonton car insurance liability third party liability

3 min read

The Implications of Having Your Insurance Cancelled for Non-Payment

By Jake McCoy on Feb 27, 2025 10:45:00 AM

Staying up-to-date on payments is an essential part of protecting yourself and your assets. However, life can throw unexpected challenges our way, and missed insurance payments can happen. As an insurance consumer, it's vital to understand the implications of such situations and what could happen if you're cancelled for non-payment. This short article will breakdown the implications of being cancelled for non-payment and some of the challenges that come with that.

Topics: payments Cancelled for Non-Payment

3 min read

Dwelling Coverage: Understanding Your Home Insurance

By Jake McCoy on Feb 25, 2025 9:30:00 AM

When it comes to protecting your home, having the right insurance coverage is essential. One of the most important components of a homeowners insurance policy is dwelling coverage. But what exactly is dwelling coverage, and why do you need it? Let's break it down.

Topics: home insurance property insurance

4 min read

How to Prevent your Car Battery Freezing in Extreme Cold

By Jake McCoy on Feb 14, 2025 11:45:00 AM

As temperatures plummet to bone-chilling levels, your car becomes more than just a means of transportation—it can be your lifeline in the freezing cold. When temperatures reach the level of "extreme cold" batteries are a common reason for vehicles not starting. Today, we wanted to provide a handful of tips and tricks to help keep your car battery from freezing.

Topics: Car Insurance Car Insurance Edmonton

4 min read

Risk Revealed: Ontario's Top 10 High-Theft Vehicles

By Jake McCoy on Feb 12, 2025 2:00:00 PM

The top 10 most commonly stolen vehicles in Ontario have been released by Canadian company Équité. We wanted to do an in-depth look at vehicle theft frequency, rather than sheer numbers. In essence, we wanted to answer the question, what type of vehicle is most likely to be stolen if you were going to purchase one? The following numbers are based on the rate at which a specific vehicle is stolen proportional to the number of vehicles on the road.

Topics: Auto Insurance Car Insurance theft

3 min read

Outbuilding Coverage for Home Insurance: What You Need to Know

By Jake McCoy on Feb 8, 2025 7:00:00 AM

When most people think of home insurance, they typically think of coverage for the main structure of their home. However, many homes also have additional structures on their property, such as sheds, detached garages, or barns. These structures are commonly referred to as outbuildings, and they can be just as vulnerable to damage or loss as the main house. That's why it's important to understand outbuilding coverage for home insurance. Here is some information to help make sure you have the right protection in place.

Topics: home insurance property insurance

3 min read

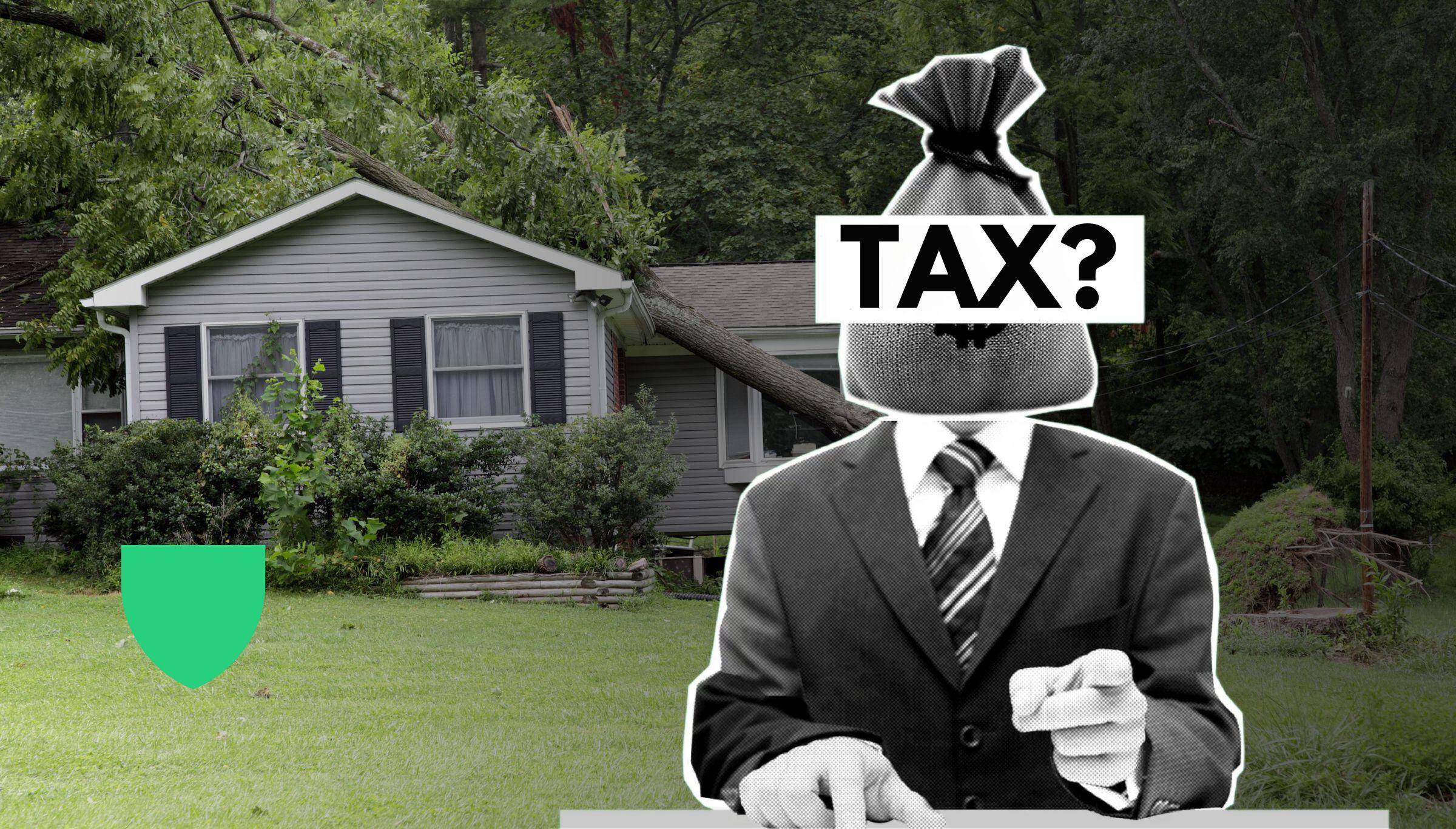

Are Insurance Claims Taxable in Canada?

By Jake McCoy on Jan 30, 2025 12:10:25 PM

A question that I get asked from time to time is: The money that is paid out in an insurance claim, is that taxable? This creates an interesting question about what is considered income. In order to answer this question, we wanted to look at a few scenarios.

Topics: Insurance Claim claim

4 min read

What the $250 Billion LA Wildfire Indicates About the Future of Insurance

By Jake McCoy on Jan 29, 2025 12:11:52 PM

In early 2025, Southern California experienced one of the worst natural disasters in US history. The LA wildfires claimed the lives of 28 people, destroyed over 17,000 structures, scorched 35,000 acres, and displaced more than 150,000 residents. According to AccuWeather, the total economic impact—including damages, loss of life, healthcare costs, business disruptions, and other economic factors—is estimated between $250 billion and $275 billion.

Topics: fire insurance disaster house fire

4 min read

How Much is Auto Insurance In Alberta? A 2024 Recap

By Jake McCoy on Jan 17, 2025 10:15:00 AM

Auto insurance is a necessity for drivers in Alberta, but how much does it actually cost? In 2024, Armour Insurance analyzed our data to provide a clear look at the average, median, and highest premiums paid by Albertans. With this data, we aim to demystify auto insurance costs and help drivers better understand what factors influence their rates,we aim to help Alberta drivers get a baseline for coverage costs.

Topics: Auto Insurance Alberta Car Insurance Reform

7 min read

How Much is Recreational Insurance In Alberta? A 2024 Recap

By Jake McCoy on Jan 16, 2025 11:00:00 AM

Recreational vehicles and watercrafts bring Albertans endless opportunities for fun and adventure, but they also come with responsibilities, like insurance. In 2024, Armour Insurance analyzed data on premiums for motorcycles, boats, RVs, trailers, ATVs, and snowmobiles to provide a clear picture of how much recreational insurance costs in Alberta. By sharing these insights, we aim to help recreational enthusiasts get a baseline for coverage costs.

Topics: Recreational Insurance Alberta Insurance

7 min read

How Much is Property Insurance In Alberta? A 2024 Recap

By Jake McCoy on Jan 13, 2025 3:05:12 PM

Owning or renting a property in Alberta brings important responsibilities: Like property insurance. In 2024, Armour Insurance analyzed data on home, condo, and tenant insurance premiums to provide a general picture of property insurance costs in Alberta. By sharing these insights, we aim to help homeowners, condo dwellers, and tenants understand their coverage needs and get a baseline for protecting what matters most.

Topics: home insurance property insurance Tenants Insurance Condo Insurance

2 min read

Photo Radar Reform in Alberta: Restricted to School, Playground, and Construction Zones

By Jake McCoy on Dec 5, 2024 9:00:00 AM

On December 2, 2024, the Alberta Government unveiled major reforms to the use of photo radar by municipalities, set to take effect on April 1, 2025. These changes aim to reduce the number of active photo radar locations from 2,200 to approximately 650, a significant reduction of about 70%.

Topics: Car Insurance Alberta Car Insurance Reform

9 min read

Alberta’s Auto Insurance Overhaul Unpacked: A Complete consumer Guide

By Jake McCoy on Nov 29, 2024 10:00:00 AM

Alberta’s auto insurance market has been at the center of scrutiny and controversy for many years. Headlines about reports on public vs. private auto insurance, rate freezes, rate increases for safe drivers, insurance companies leaving the province, and the latest announcement about Alberta’s sweeping changes to the insurance industry. With all of this in mind you might be asking yourself: What is happening to Alberta car insurance? We’d like to take an opportunity to break down the state of Alberta auto insurance and what changes could look like.

Topics: Car Insurance Alberta Car Insurance Reform

6 min read

5 Things to Know About Home Insurance and Animal-Related Damage

By Jake McCoy on Nov 18, 2024 10:30:00 AM

You might not know it, but home insurance and animals often have a complicated relationship. What kinds of things can be covered, and what aren’t? From a loyal pet’s mishap to an invasion of pests, there are plenty of questions about where your home insurance can step in. Knowing the basics can help you understand which risks are yours to manage and which fall under your policy’s protection.

Topics: property insurance pet insurance Pet Shield

4 min read

Do Old Cars Cost Less To Insure?

By Jake McCoy on Nov 9, 2024 7:45:00 AM

When it comes to car insurance, many drivers wonder if owning an older car means lower insurance rates. While it's true that some aspects of insuring an older vehicle can be less expensive, it's not always the case. This article will help clarify the difference between older cars and classic cars and some of the other factors that go into your car insurance premium.

Topics: Auto Insurance Car Insurance Car Insurance Edmonton classic car

3 min read

Beware of Ghosts: Protect Yourself from Auto Insurance Scams in Alberta

By Jake McCoy on Oct 24, 2024 10:15:00 AM

As auto insurance is a legal requirement in Alberta, it’s essential to ensure you're getting your insurance from a legitimate and licensed agent or broker. Unfortunately, there has been a rise in fraudulent auto insurance scams by unlicensed individuals, commonly referred to as “ghost brokers.” These scammers often target newcomers or those unfamiliar with Alberta’s insurance system, leaving unsuspecting drivers vulnerable to invalid insurance coverage.

Topics: Insurance Fraud Car Insurance

3 min read

Meet the Team: Armour Team Leads

By Jake McCoy on Oct 10, 2024 11:45:00 AM

At Armour Insurance, our commitment to exceptional service is at the heart of everything we do. As Armour continues to grow, we're focused on maintaining the high level of personal care and expertise our clients have come to expect. To support this goal, we're excited to announce the promotion of three of our outstanding insurance brokers to Personal Insurance Team Lead positions this quarter. These individuals have demonstrated exceptional leadership, dedication, and industry knowledge, and we're confident that in their new roles, they will continue to enhance the experience for our clients and team members alike.

Topics: Armour Insurance staff

3 min read

Will Home Insurance Cover It? 5 FAQs of Home Insurance Coverage

By Jake McCoy on Sep 26, 2024 10:17:25 AM

Home insurance can be confusing, especially when it comes to understanding what is and isn’t covered. To help you navigate the complexities, we've compiled answers to the top five frequently asked questions about home insurance coverage. Whether you're wondering about damage to your AC unit or concerns about bed bugs, we’ve got the info you need.

Topics: home insurance property insurance Insurance Claims

2 min read

What is Seasonally Rated Insurance?

By Jake McCoy on Sep 9, 2024 1:45:00 PM

When you live in a place like Alberta or Saskatchewan and you own something like a motorcycle, boat, or snowmobile, you're probably not able to use it year-round. That’s where seasonally rated insurance comes in. Let's dive into how this type of insurance works and why it can be so cost-effective.

Topics: Car Insurance Recreational Insurance recreational vehicle insurance

4 min read

Will Home Insurance Cover It? The Top 7 FAQs of Home Insurance Claims

By Jake McCoy on Aug 25, 2024 10:06:00 AM

Home insurance can be confusing, especially when it comes to understanding what is and isn’t covered. To help you navigate the complexities, we've compiled answers to the top seven frequently asked questions about home insurance claims. From water damage to solar panels, we’ll cover the basics of home insurance coverage.

Topics: home insurance

4 min read

Alberta Hidden Gems: 5 Lesser-Known Parks to Explore

By Jake McCoy on Jul 20, 2024 9:30:00 AM

Jasper and Banff often steal the spotlight, but Alberta is home to many breathtaking parks perfect for a summer adventure. Here are five lesser-known parks that promise a mix of relaxation, fun, and unique experiences.

Topics: travel insurance trailer insurance

1 min read

Tech Outage Impacting Insurance Software Across Canada

By Jake McCoy on Jul 19, 2024 9:55:00 AM

This morning a tech outage was announced impacting services across the world from banks to airlines. One of the largest insurance software providers in North America, Applied Epic, is also on that list. This software back ends nearly all information between clients and their insuring company. CrowdStrike has reported that the source for the outage is not the result of a cyber attack but rather an update that was pushed out to customers.

Topics: cyber insurance Alberta Insurance

7 min read

What Does Sonnet Leaving Alberta Auto Insurance Signal For the Industry?

By Jake McCoy on Jul 17, 2024 6:45:00 PM

The Alberta auto insurance market is in flux as both Sonnet Insurance and Aviva Direct Insurance have opted to leave the province (Sonnet auto only and Aviva Direct entirely). This sudden change in the market has left many with questions. Why did these companies leave Alberta? Is Alberta car Insurance bad business? What does this mean for policyholders with these insurance companies? Today, we seek to provide answers to some of these questions.

Topics: Online Quotes Auto Insurance Car Insurance

7 min read

Protecting Your Business with Cyber Insurance

By Jake McCoy on Jul 14, 2024 12:45:00 PM

In today's digital age, businesses rely heavily on technology to manage their operations, communicate with customers, and store sensitive data. However, with the rise of cyber threats such as hacking, data breaches, and malware or ransomware attacks, businesses are increasingly vulnerable to cybercrime. As a business owner, it's crucial to protect your business from cyber threats with the right insurance coverage.

3 min read

What to do if Your Brakes Fail on the Road

By Economical Insurance on Jul 2, 2024 5:15:00 AM

If you’ve never experienced a brake failure, the thought of one happening likely doesn’t cross your mind too often. But if you have experienced a brake failure on the road, you know how important it is to be ready to react in a split-second. We can help make sure you’re prepared.

Topics: car Auto Insurance car accident featured car safety

1 min read

Armour Day off Raffle Supports Stollery Children's Hospital Foundation - Racing For the Cure

By Jake McCoy on Jun 19, 2024 10:02:45 AM

At Armour Insurance, we love finding ways to give back to the community and offering innovative perks to our team members. When you combine both of those together, you get the Armour day off raffle program. The program is pretty simple: Armour team members from all levels can purchase raffle tickets for $2 each. At the end of the month at one of our famous happy hours, we take all of the tickets that were purchased throughout the month, and we draw one ticket out. The person who purchased the winning ticket wins an additional paid day off!

Topics: Culture Armour Insurance staff

5 min read

Insurance Companies and Climate Change: What's Being Done?

By Jake McCoy on Jun 5, 2024 1:51:06 PM

Insurance companies are in the business of risk management and mitigation. They use data and analytics to determine the likelihood of a risk occurring and what the costs for the respective damages would be if it were to happen. If insurance is not available or prohibitively expensive, the risk is probably quite high. This leads us to the main question of the day; what is the risk climate change poses to Canadians and what insurance companies are doing about it?

Topics: Inflation Alberta Insurance Climate Change

4 min read

Co-Insurance Explained: The Hidden Cost of Underinsuring Your Property

By Jake McCoy on May 23, 2024 2:00:00 PM

Co-insurance remains one of the most perplexing concepts in insurance, often leaving policyholders puzzled about its implications. In this article, we aim to demystify co-insurance by shedding light on what it entails and how it works.

Topics: Commercial Insurance Alberta Commercial Insurance Quotes Co-Insurance

2 min read

Intact Insurance Partners with Wildfire Defense Systems Ahead of Wildfire Season

By Jake McCoy on May 13, 2024 9:15:00 AM

Intact Insurance has partnered with Wildfire Defense Systems (WDS) ahead of the 2024 wildfire season. This is just one of the measures that Intact Insurance has made to protect the personal property of their customers in Alberta and British Columbia.

Topics: fire insurance fire safety intact insurance

5 min read

The 5 Most Common Types of Water Damage and How to Prevent them

By Jake McCoy on May 2, 2024 1:45:00 PM

Water damage can be a homeowner's worst nightmare, causing not only financial strain but also health hazards if left untreated. Understanding the common types of water-related home insurance claims and implementing preventive measures can save you from costly repairs and headaches down the line. Here’s a breakdown of the most prevalent types of water damage and how you can mitigate the risks.

Topics: home insurance Water damage home maintenance

2 min read

Growing Cannabis at Home: How it Affects Your Property Insurance

By Jake McCoy on Apr 17, 2024 4:20:00 PM

In the summer of 2001, the Canadian government legalized cannabis for medical use. By the fall of 2018, it became legal for personal consumption as well. Since then, cannabis use, and even home cultivation, has become increasingly normalized across the country.

Topics: home insurance Cannabis

2 min read

How to Identify the Age of Your Furnace and Water Heater

By Jake McCoy on Mar 28, 2024 11:30:00 AM

Knowing the age of your furnace and water heater is crucial for insurance purposes. Insurance companies often consider the age of these appliances when determining coverage and premiums. Accurately identifying the age of these home components is essential for ensuring adequate insurance coverage.

Topics: home insurance

2 min read

How to Tell When Your Roof Was Last Updated

By Jake McCoy on Mar 27, 2024 11:15:00 AM

Insurance companies often inquire about the age of your roof to assess its condition and potential risk factors. Knowing the age of your roof can impact insurance coverage eligibility and premiums, as older roofs may be more prone to damage or may be near the end of their useful lives.

Topics: home insurance home maintenance

4 min read

How to Identify the Type of Plumbing your Home Uses

By Jake McCoy on Mar 25, 2024 1:00:00 PM

Understanding the type of plumbing in your home is vital for maintenance, renovations, and insurance purposes. Different plumbing materials come with unique lifespans and maintenance needs, so it's crucial to know what you have. Here's a simple guide to help you identify the type of plumbing in your home.

Topics: home insurance

6 min read

Weathering the Storm: Climate Change and Alberta Insurance

By Jake McCoy on Mar 16, 2024 10:44:16 AM

Earlier this month, I got a letter from my insurance company about how my property insurance deductibles were being increased from $1,000 to $2,000 on hail damage and water damage. On the one hand, I was happy to hear that my premiums weren’t going up, but on the other hand, I was a little surprised to see that my deductible was literally doubling from last year with no claims or changes to my policy. When I got this news, I did what most people would do, and I gave my broker a call to ask why this happened.

Topics: Car Insurance property insurance disaster

2 min read

Armour Alliances: Bioclean Disaster Services

By Jake McCoy on Mar 14, 2024 3:56:25 PM

As a part of the Armour Advantage program for commercial insurance clients, Armour does something we like to call a commercial client showcase. A client showcase promotes our clients and the excellent work that they do. This month’s client is Bioclean Disaster Services a certified disaster cleanup service with a green twist.

Topics: property insurance disaster commercial insurance

5 min read

3 Reasons I wish I had Purchased Tenant Insurance

By Jake McCoy on Mar 4, 2024 1:45:00 PM

In the whirlwind of moving into a new rental property, it's easy to overlook the importance of tenant's insurance. After all, you've just signed a lease, paid a security deposit, and are busy planning the layout of your new home. But what if I told you that tenant’s insurance isn’t just another added expense, but an incredibly important part of moving out? Take it from someone who had to learn it the hard way, tenant insurance should be a top priority when you move out.

Topics: home insurance property insurance Tenants Insurance

3 min read

Stay Dry With Umbrella Insurance: Because When It Rains, It Pours

By Jake McCoy on Feb 10, 2024 10:15:00 AM

In this litigious world, protecting yourself and your assets from liability is both important and increasingly difficult. While insurance policies such as auto, homeowners, and renters insurance have liability protection to financially protect you in a lawsuit, there are situations where they may not be enough. This is where umbrella insurance comes into play, offering an additional layer of protection beyond the limits of your standard insurance policies.

6 min read

Alberta Auto Insurance Grid Rates Explained

By Jake McCoy on Jan 26, 2024 10:30:00 PM

If you’ve ever gotten a quote on auto insurance in Alberta, you may have heard the agent or the broker talk about insurance grid rates. If you’re not an insurance professional, the term “grid rate” probably doesn’t mean that much to you. Today we want to provide a short guide to understanding what “grid rates” are, what they do, and what it means for you.

Topics: Car Insurance Quote Auto Insurance Car Insurance Car Insurance Edmonton Auto Insurance Edmonton Grid Rating Insurance Grid Rating

Congratulations to Our $1K Giveaway Winners!

By Jake McCoy on Jan 22, 2024 2:00:00 PM

Throughout December and early January, we ran a $1,000 giveaway. Anyone who quoted their insurance or referred a client to Armour Insurance was eligible for the draw.

Topics: Car Insurance Quote contest contestwinner

2 min read

Edmonton Offers a Backwater Valve Subsidy for Basement Flooding

By Rob Stevenson on Jan 11, 2024 11:49:00 AM

Topics: flood insurance home insurance Basement Flooding flood flooding Edmonton

2 min read

10:4 and the Top Used Trucker Terminology Good Buddy

By Rob Stevenson on Jan 5, 2024 11:17:00 AM

"You know who that is? That's Mr. Evil Knievel. He snuck in my back door, son, when I wasn't lookin'. You better flip-flop back here and gimme' a hand, son, or we gonna be in a heap of trouble. Please roger that transmission!"

3 min read

How Much Is Motorcycle Insurance in Alberta? A 2023 Update

By Jake McCoy on Dec 23, 2023 5:45:00 AM

With the 2023 Alberta riding season nearing its natural conclusion, we wanted to look back at how much motorcycle insurance costs in Alberta during the year. In the name of transparency Armour has compiled the data to get an accurate assessment of how much it costs to get motorcycle insurance.

Topics: motorcycle insurance motorcycle theft motorcycle safety

3 min read

Top 7 Ways to Keep Windshield Chips From Spreading

By Rob Stevenson on Dec 13, 2023 11:33:00 AM

If you can drive on Alberta Roads for more than a month without getting a chip in your windshield, you deserve a medal! Keeping your windshield free of cracks and chips is quite possibly one of the most frustrating things about driving in northern climates like ours. The last windshield I replaced lasted only 5 months before developing a long horizontal crack.

Topics: Car Insurance windshield chips

4 min read

Guide to Commercial Auto Insurance: Answering FAQ's

By Jake McCoy on Nov 29, 2023 11:00:00 AM

Commercial auto insurance is a critical component for businesses relying on vehicles as part of their operations. This will provide answers to common FAQs regarding commercial auto insurance, coverage options, and policy requirements. Whether you're a business owner or an employee using company vehicles, this guide will provide the clarity you need to make informed decisions and safeguard your assets.

Topics: Commercial Insurance Alberta Commercial Insurance rates Commercial Automobile Insurance

4 min read

Alberta Auto Insurance Reforms Start by Defining "Safe Drivers"

By Jake McCoy on Nov 1, 2023 10:40:03 AM

On November 1, 2023, the Alberta government held a press conference with to announce changes to the auto insurance landscape for Alberta. Key takeaways from the press conference include:

Topics: Car Insurance Alberta Insurance Alberta Car Insurance Reform

8 min read

What Happens to Your Cyber Security When You Think Like a Hacker?

By Jake McCoy on Oct 26, 2023 9:30:00 AM

In September 2023, Armour Insurance and Accurate Network Services teamed up to host the first-ever Think Like a Hacker event. The event was all about how to protect yourself, your clients, and your business from cyber security threats. We wanted to take this opportunity to share some of the insights and maybe allow you to Think Like a Hacker too.

Topics: commercial insurance cyber crime cyber insurance

6 min read

Insurance Inflation 2023 Update: Personal Car Insurance

By Jake McCoy on Oct 25, 2023 7:00:00 PM

At Armour Insurance, transparency is one of our most important core values. We do our best to be transparent with our team, our partners, and of course our valued customers. So, in the spirit of transparency, we'd like to share some of the data we have on insurance prices year over year in Alberta.

Topics: Car Insurance Car Insurance Edmonton Inflation

9 min read

4 Terrible Ways to Get Cheap Car Insurance

By Jake McCoy on Oct 10, 2023 12:45:00 PM

A vast majority of car insurance shoppers in Alberta are looking for one thing and one thing only: the cheapest possible insurance for their cars. In all fairness, we get it. At the end of the day, the almighty dollar is what reigns supreme for most consumers. With that being said, we hope that by reading this short article, we might be able to change a few minds. That maybe, just maybe, price shouldn't be the only thing you care about.

Topics: Car Insurance Quote Car Insurance Car Insurance Edmonton

6 min read

3 Things I Look For When Shopping For a Used Vehicle (With Resources to Help)

By Jake McCoy on Sep 13, 2023 12:22:00 PM

When you’re in the market for a new to you vehicle, there are usually a handful of criteria that you use to make a purchase decision. Does it meet your needs? Can you afford it? Does it look how you want it to? Is it reliable? Is it safe? These are all important questions you should be asking before you make a vehicle purchase. Today we wanted to provide a few resources and ways on how you can answer three of the pressing questions you might have when shopping for a vehicle.

Topics: Car Insurance New Car used car car tips

2 min read

Motorcycle Insurance - What You Need to Know

By Rob Stevenson on Aug 23, 2023 2:45:00 PM

To drive your motorcycle on the road in Canada, you must carry a form of liability insurance called motorcycle insurance. The basic version of this insurance will get you on the road legally, but there are many more options you may want to consider when insuring your motorcycle. We sat down with our motorcycle expert, Bonita Paisley to get a better handle on all of the ins and outs of motorcycle insurance.

Topics: motorcycle insurance

2 min read

Navigating Wet Roads and Debris: A Guide to Getting There Safely

By Jake McCoy on Aug 18, 2023 10:09:21 AM

When it comes to driving, safety should always be the top priority. After a heavy storm, it's common to have wet roads and even debris. This can make the road slick, lead to hydroplaning, or create barriers/obstacles on the road. In order to navigate the roads safely, we have put a few helpful tips and tricks together.

Topics: Car Insurance car tips Defensive Driving

3 min read

7 Defensive Driving Techniques to Ensure Road Safety

By Jake McCoy on Aug 12, 2023 10:45:00 AM

Defensive driving is a set of driving skills, techniques, and behaviors that prioritize safety and proactive decision-making to reduce the risk of accidents, injuries, and conflicts on the road. It involves being vigilant, aware of one's surroundings, and prepared to respond effectively to potential hazards and unexpected situations. By mastering these techniques, you'll not only enhance your own safety but also make our roads a safer place for everyone.

Topics: UBI Intact app car tips Defensive Driving

5 min read

5 Essential Vehicle Skills Every Driver Should Know

By Jake McCoy on Jul 23, 2023 10:00:00 AM

Owning a vehicle comes with the responsibility of understanding some of the basics for being on the road. Whether you're a seasoned driver or a novice, knowing these fundamentals can prove invaluable. In this article, we'll cover five essential vehicle skills that every driver should be familiar with.

Topics: Auto Insurance car tips

4 min read

How Much a Distracted Driving Ticket Could Cost You

By Jake McCoy on Jul 16, 2023 11:00:00 AM

Distracted driving poses a significant risk on the roads, extending beyond the commonly associated use of cell phones. Engaging in any activity that diverts attention from driving can lead to accidents and consequences. In this article, we delve into the various forms of distracted driving and shed light on the true costs of receiving a distracted driving ticket in Alberta.

Topics: Auto Insurance Car Insurance distracted driving

6 min read

How to Buy a Car With Cheap Insurance

By Jake McCoy on Jul 7, 2023 10:21:00 AM

In the market for a new vehicle? An important part of purchasing a new vehicle is being able to afford all of the costs associated with ownerships. This includes the payment (if it’s financed), the maintenance costs, the repair costs, the operating costs, and of course, the cost to register and insure the vehicle. Having a firm grasp of the expected expenses will set you up for success when purchasing a vehicle. Today, we wanted to breakdown the factors that go into a car insurance premium and how to find a vehicle with insurance you can afford.

Topics: Car Insurance Quote Car Insurance Car Insurance Edmonton

5 min read

Auto Insurance Endorsements: The Added Coverage Options

By Jake McCoy on Jun 6, 2023 11:00:00 AM

A car insurance endorsement, also known as a rider or a policy endorsement, is a modification or addition to an existing auto insurance policy. It is a way for policyholders to customize their coverage to better suit their specific needs or to add greater protection than what is included in a basic policy.

Topics: Car Insurance Quote Auto Insurance Car Insurance Car Insurance Edmonton

2 min read

Commercial Insurance Tips for New Business Owners

By Alannah McEwan on Jun 3, 2023 9:00:00 AM

When looking for business insurance coverage, many new business owners find themselves overwhelmed. There is no one size fits all when it comes to business insurance as every business is unique. Talking to a professional broker that specializes in commercial insurance can help you better understand your options and find a package that best fits your business.

Topics: commercial insurance business insurance

9 min read

What Goes Into a Car Insurance Premium?

By Jake McCoy on Jun 2, 2023 10:30:00 AM

Whenever you're getting any kind of insurance, the agent or broker will ask you a plethora of questions. Once the agent or broker has gotten the answers they need, they will come back to you with the different coverage options available and the price that those coverage options will cost you. You may have wondered, what truly goes into a car insurance premium?

Topics: Auto Insurance Car Insurance Car Insurance Edmonton Auto Insurance Edmonton

3 min read

5 Must-Visit Road Trip Destinations in Alberta

By Jake McCoy on May 26, 2023 9:30:00 AM

Embarking on a road trip through Alberta, Canada, promises an unforgettable adventure. From towering mountains to sprawling prairies and breathtaking national parks, this province has it all. Buckle up and get ready to explore five must-visit road trip destinations that showcase the natural wonders and rich heritage of Alberta.

Topics: Car Insurance roadside assistance Road Trip

4 min read

5 Things You Need for the Best Car Insurance Quote

By Jake McCoy on May 19, 2023 9:00:00 AM

Getting car insurance can be a bit of a chore, but it doesn’t have to be! By using a brokerage like Armour Insurance, we can shop Canada’s top insurance markets to find you the best possible price for your coverage. Before we get you set up with a quote, we’ll need a little information from you first.

Topics: Car Insurance Quote Car Insurance Core Values

3 min read

The Armour Healthy Lifestyle Commitment

By Jake McCoy on May 17, 2023 10:30:00 AM

A big part of the Armour Insurance culture is our commitment to employee health. We believe that the health and well-being of our team members is crucial to our success. That's why we're committed to promoting a healthy lifestyle, both physically and mentally. We're proud to offer a range of programs and initiatives to support our staff in achieving their health and wellness goals.

Topics: Core Values Culture Armour staff Armour Insurance staff

4 min read

DCPD For Alberta Car Insurance: What is it and how does it work?

By Jake McCoy on May 11, 2023 10:45:00 AM

DCPD is an insurance acronym that stands for Direct Compensation for Property Damage. DCPD was introduced in Alberta on January 1, 2022, as a part of the Alberta governments auto insurance reform measures. DCPD is used in several Canadian provinces including, Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland. The results of DCPD have been faster claims response, consistent treatment during claims, and drastically lower litigation costs.

Topics: Auto Insurance Car Insurance Car Insurance Edmonton DCPD

7 min read

Collision Coverage For Car Insurance: Deductibles, Hit and Runs, and When to Make a Claim

By Jake McCoy on May 9, 2023 1:45:54 PM

Learn the differences between liability, comprehensive, and collision insurance coverage, and why collision insurance may be necessary. Collision coverage is the only type of coverage that financially protects the insured's vehicle in an accident, regardless of who's at fault. Learn when collision coverage is required, such as when financing a vehicle. See the different deductibles available to you and the point at which you should make a claim on your insurance.

Topics: Auto Insurance Car Insurance Car Insurance Edmonton collision car accident

4 min read

Comprehensive Car Insurance: Protecting Your Vehicle and Your Wallet

By Jake McCoy on May 2, 2023 2:25:44 PM

When it comes to protecting your car, comprehensive car insurance is an essential coverage to consider. It provides coverage for your vehicle in case of theft, fire, vandalism, or other types of damage that are not caused by a collision with another car.

Topics: Auto Insurance Car Insurance Car Insurance Edmonton Auto Insurance Edmonton Comprehensive

2 min read

Armour Insurance Native Plant Garden

By Jake McCoy on Apr 22, 2023 10:30:00 AM

In the summer of 2022, Armour Insurance partnered with Aviva Canada and the Canadian division of the World Wildlife Fund (WWF) to create a native plant garden for the Armour Edmonton office (located at 5750 75st NW). Where their was once gravel, rocks, and dust, there is now a brilliant garden full of plants native to the area.

Topics: Aviva Insurance Armour staff Armour Insurance staff House Plants

2 min read

Do Photo Radar Tickets Affect My Insurance?

By Alannah McEwan on Apr 14, 2023 9:08:00 AM

Speeding is by far the most common traffic ticket given out in Canada. Do you know which traffic tickets will increase your insurance rates? Will photo radar and police issued tickets have the same impact on your insurance and driving record?

Topics: Car Insurance Quote Car Insurance distracted driving

2 min read

How To Register to Be an Organ Donor In Alberta

By Jake McCoy on Apr 7, 2023 10:15:00 AM

In honour of Logan Boulet, Humboldt Broncos defenceman, April 7th is green shirt and organ donation awareness day, we wanted to create a short guide on how you too can register to be an organ and tissue donor in the province of Alberta.

Topics: donation

1 min read

Armour Day Off Raffle Program Supports Racing for the Cure

By Jake McCoy on Apr 3, 2023 1:47:13 PM

At Armour Insurance, we know how valuable a day off can be, which is why we created the day off raffle program! Every month, Armour Insurance sells day off raffle tickets to our staff for $2 each. The Armour team draws someone's ticket each month, and that person gets a bonus paid day off! There is no limit to how many tickets one person can purchase.

Topics: Armour staff donation donate

3 min read

Does the Fog Look Like Pea Soup? Here's 7 Tips to Help You Through It

By Jake McCoy on Mar 16, 2023 12:45:00 PM

If you're an Albertan like me, you're probably not used to thick fog on your commute to work. My friends and family over in BC look at this thick fog and they think nothing of it really. Today is just a regular Tuesday for them. For me? I was white knuckling it on my way into the city. In order to help my fellow Albertan's, here are 7 helpful tips to getting you through the fog safely.

Topics: Auto Insurance Alberta Alberta Insurance Fog Defensive Driving

4 min read

How One Call Saved Me Money on My Phone Plan: How You Can Benefit Too

By Jake McCoy on Mar 10, 2023 9:09:00 AM

On Saturday afternoon I was relaxing on my couch with my girlfriend watching some of the afternoon hockey games. We kept getting the same couple of ads for new cellphones, which I should indicate came at a rather timely moment. Our phone contract ended in January of this year and I hadn't gotten around to really looking for what kind of new phone I might want next.

Topics: group insurance

4 min read

5 Common Causes of Spring Flooding and How to Avoid Them

By Jake McCoy on Mar 3, 2023 11:30:00 AM

As the weather warms up and snow starts to melt, spring can bring an increased risk of flooding in homes. Whether it's heavy rainfall or melting snow, excess water can seep into basements and crawlspaces, causing costly damage to homes and belongings. Fortunately, many causes of spring home flooding can be prevented with some simple steps. We'll explore some of the most common causes of spring home flooding and provide practical tips on how to prevent them. By taking these measures, you can help safeguard your property and prepare for the season ahead.

Topics: home insurance property insurance Basement Flooding flooding Homeowners Floods

4 min read

The Surprising Benefits of Property Insurance: 4 Things Covered Beyond Your Home

By Jake McCoy on Feb 17, 2023 10:45:00 AM

When it comes to protecting your home, property insurance is a must-have. However, many homeowners are unaware of the additional benefits that property insurance can provide beyond just coverage for the physical structure of their home. From personal property protection to identity theft protection, property insurance can offer a wide range of protections for your assets. In this article, we'll explore the surprising benefits of property insurance and show you how you can use it to protect more than just your home.

4 min read

Sewer Backup Insurance: A Must-Have for Homeowners

By Jake McCoy on Feb 8, 2023 3:30:00 PM

Sewer backups, the homeowner equivalent to being up a creek without a paddle. A sewer backup refers to the flow of wastewater into a home due to blockages or damage in the sewer lines, heavy rainfall, or overwhelmed sewer systems. It can cause damage and pose a health hazard. In order to get you the best information on sewer backups, we have created this comprehensive guide to help you make the most informed decision.

1 min read

Congratulations to Our $1,500 Quote Contest Winners!

By Jake McCoy on Feb 3, 2023 3:25:15 PM

Through December 2022 and early January 2023, we were running a $1,500 quote contest with Armour Insurance. Anyone who got a quote with Armour or referred a someone to get a quote with Armour was eligible to win.

Topics: contestwinner

3 min read

Snowmobile Theft: What Can Insurance Do?

By Jake McCoy on Jan 29, 2023 9:53:00 AM

Over the Christmas break, some family friends of ours had their snowmobiles stolen right off their flatbed trailer. It was on relatively well lit street, the snowmobiles were tied down and didn't have the keys in them, and they weren't in a seedy area where you might expect something like this. Despite all of this, they still had their snowmobiles stolen in the early hours of boxing day.

Topics: Comprehensive snowmobile Snowmobile Insurance

2 min read

Alberta Government Freezes Insurance Rates and Opens Up Payment Plans

By Rob Stevenson on Jan 27, 2023 2:34:54 PM

The Alberta government announced on January 25, 2023 that they would be freezing auto insurance rates and making it easier for residents to pay monthly for their insurance. We wanted to clarify what this all means for Albertans, how your it impacts your insurance premiums this year, and what it will mean going forward.

Topics: Car Insurance Insurance Premiums Inflation Alberta Insurance

3 min read

8 Sounds Your Vehicle Makes and What They Could Mean

By Jake McCoy on Jan 20, 2023 11:15:00 AM

If your car is making any sound other than the typical operating noises, you probably have some issues with your vehicle. In order to help your avoid expensive auto repairs it's good to proactively listen to what your car is telling you. Keeping an ear out for unusual sounds in your car can help you identify potential problems early and prevent costly repairs. Here are some common car sounds and what they may indicate:

Topics: Car Insurance

3 min read

Convictions: How do they impact your auto insurance?

By Jake McCoy on Dec 31, 2022 12:06:16 PM

Convictioncan be a bit of a scary word. In this context, convictions are not quite as dramatic as a Law and Order kind of convictions. In this case, a conviction refers to a driving conviction on your record. A driving conviction is when you get a pullover ticket where you were cited by the police for breaking the law.

*Note that only pullover tickets caused by your driving behaviour will impact your insurance.

Topics: Auto Insurance

5 min read

The Car Wouldn't Start This Morning - Here's What I Did

By Jake McCoy on Dec 20, 2022 5:30:00 PM

This morning in Leduc County, where I am currently living, it was -43˚C when accounting for the wind chill. Given that it is December 20th in central Alberta, this kind of weather isn't really out of the ordinary. Living on an acreage, we park our vehicles outside on the driveway overnight. With multiple people living in the house, we have 4 vehicles on the property.

Topics: Car Insurance Culture

4 min read

Earthquakes in Alberta - What Does Insurance Cover?

By Jake McCoy on Dec 2, 2022 2:01:39 PM

The province of Alberta is not usually known for it's natural disasters. In actuality, it's quite the opposite. The land-locked nature of the province prevents tsunamis and hurricanes, the relatively flat nature of the province isolates the risk of landslides and avalanches, and volcanic eruptions aren't a concern for obvious reasons.

Outside of forest fires and the odd tornado, Alberta is typically safe from most other kinds of natural disasters. Most people probably would have said that earthquakes are a non issue in Alberta, up until recent events anyway.

3 min read

Travel Delays are the WORST

By Jake McCoy on Nov 23, 2022 9:45:00 AM

Airline travel is arguably one of the most dreaded parts of holidays or trips. You're trying to get to the airport on time, find a parking spot, get all your luggage and documents ready, and get everything you need to get done at the counter. Then you get to wait in the grueling lineup at airport security. All of that is just a part of the flying process. But that sinking feeling when you look up at the flight screen to see that your flight has been delayed? That feels demoralizing.

Topics: travel insurance travelers insurance vacation Tugo My Flight My Flyt

4 min read

Glass Insurance - Should I get it?

By Jake McCoy on Nov 15, 2022 10:15:00 AM

Vehicle insurance can cover many different types of damages or losses. One of the items that your auto insurance will not likely cover is your automotive glass. Your windshield, side windows, back glass, and a sun/moon roof on your vehicle are all components that could be damaged and not have coverage. For this very reason, you can purchase a supplemental glass insurance policy to cover chips, cracks, or broken glass on your car.

Topics: Car Insurance Quote Auto Insurance Glass Insurance Auto Glass Insurance

3 min read

Out of Province Guide to Alberta Auto Insurance - Alberta is Calling

By Jake McCoy on Nov 11, 2022 11:45:00 AM

Are a Canadian citizen considering making the move to Alberta? We want to help. We understand that moving is one of the most stressful things a person can do. In order to make things a little easier, here is a short out of province guide to auto Insurance.

Topics: Auto Insurance Out of Province Insurance Alberta Insurance

1 min read

SMI Rebrands to Sandbox Mutual Insurance

By Jake McCoy on Nov 8, 2022 2:45:00 PM

Big news coming from Saskatchewan Mutual Insurance. Our partner, SMI has rebranded as Sandbox Mutual Insurance. Sandbox has launched with a fresh new brand with amazing bright colours, a clean simple look, and a fantastic new logo. Out with the old and in with the new.

Topics: smi Saskatchewan Insurance Sandbox Insurance Sandbox Mutual Insurance

6 min read

Navigating Alberta Driver's Licences - Alberta is Calling

By Jake McCoy on Nov 5, 2022 10:41:00 AM

Are a Canadian citizen considering making the move to Alberta? We want to help. We understand that moving is one of the most stressful things a person can do. In order to make things a little easier, here is a short guide to navigating Alberta licenses.

Topics: Teen Driver vehicle registration Armour Registry Driver's Licence

2 min read

Snowmobile Insurance Basics

By Jake McCoy on Oct 28, 2022 11:15:00 AM

Snowmobiles are a fun and exciting way to get out of the house during the cold winter months, but it's important to make sure that you're being safe and acting within the confines of the law. If you're one of the thousands of Albertans own and operate snowmobiles every year, it's important to make sure you have the right coverage for your sled.

Topics: snowmobile Snowmobile Insurance

2 min read

Renters on Vacation

By Jake McCoy on Oct 21, 2022 10:30:00 AM

Renters: Are you going on vacation? Here’s everything you need to know before you go.

Topics: home insurance Tenants Insurance vacation

10 min read

The Basics of Winter Tires

By Jake McCoy on Oct 15, 2022 11:15:00 AM

With winter beginning to rear its ugly head in the province of Alberta, so to is it time to think about how you are going to get prepare your vehicle for winter. Outside of double checking your block heater cord, making sure you're using sub-zero rated washer fluid, and load testing your vehicles battery, you're probably going to need to do something with your vehicle's tires. If you're not 100% on what you're going to do this year, here is a few points to be your food for thought.

Topics: Auto Insurance winter driving

4 min read

Important Changes to Edmonton Collision Reporting

By Jake McCoy on Oct 12, 2022 1:30:45 PM

As of Thursday September 29, 2022, Edmonton Police Services will no longer process minor collision reports. Instead, they are asking that if you are in a vehicle collision that you report to a Collision Reporting Centre. There will be two physical locations for CRC's.

Topics: Auto Insurance insurance edmonton Auto Insurance Edmonton city of edmonton edmonton car insurance collision

3 min read

I HATE Waiting on Hold

By Jake McCoy on Oct 7, 2022 11:00:00 AM

I know it almost goes without saying that everyone hates waiting on hold. The dreaded ding ding dong of the scratchy hold music makes most people incredibly annoyed. I'm sure we've all been there, waiting on hold with a shipping company, airline, passport office, or somewhere else with terribly long hold times.

Topics: Culture Armour staff

6 min read

10 Items That Should Be In Your Vehicle

By Jake McCoy on Oct 4, 2022 11:45:00 AM

If you're one of the nearly 4 million registered motor vehicle operators in Alberta you might want to consider having these items to your vehicle. In the event of an emergency or other unexpected situation, these items can get you out of a jamb.

2 min read

Aviva Electric Vehicle Initiative

By Jake McCoy on Sep 26, 2022 10:15:00 AM

As a part of a commitment to combatting climate change, Aviva (one of our fantastic partners) has announced an electric vehicle initiative. This exciting new initiative will be available for personal use electric powered vehicles.

Topics: Aviva Insurance electric vehicle

3 min read

Getting Covered for Identity Theft

By Jake McCoy on Sep 20, 2022 11:07:00 AM

What is identity theft?

Identity theft is a criminal offense where an individuals personal information has been compromised by someone who intends to commit fraud under the guise of your name. Your name, your drivers license, social insurance number, and many other sources can cause your identity compromised.

Topics: home insurance identity theft Tenants Insurance

7 min read

Are These Common Houseplants Pet Safe?

By Jake McCoy on Sep 16, 2022 10:38:00 AM

Houseplants are becoming a staple of households all across Canada with the industry growing at 50% rate year over year from 2020 onward. This coupled with a wave of pandemic pets being adopted means that homes have more pets and more plants than ever before! With this information in hand, our friends at Pet Shield Insurance are working with Armour to do our part to make sure your pets are healthy in their home.

Topics: home insurance Homeowners Tenants Insurance pet insurance House Plants

2 min read

Storing a Boat? Do You Still Need Insurance If You're Not Using It?

By Jake McCoy on Sep 15, 2022 10:36:00 AM

After a summer full of adventure and activities, it’s finally time to put your boat into storage. You might be questioning if you really need insurance on a boat you're not actively using.

Topics: Boat Insurance Boating Boat Storage

3 min read

ATV Insurance Basics - Why Do I Need ATV Insurance? What Does It Cover?

By Jake McCoy on Sep 13, 2022 10:35:00 AM

ATV/quad sales in Alberta have spiked to incredibly high levels during a the COVID riddled year of 2021. There was a staggering 190% increase in quad sales from March 2021 to the previous years numbers. With so many extra units out there, it is important to know what kind of coverage you need for your ATV or quad in order to be compliant with Alberta regulations.

Topics: atv quad safety liability ATV Insurance Quad Insurance

1 min read

Armour Is Rebranding!

By Jake McCoy on Sep 9, 2022 11:16:47 AM

In light of the 25 years of Armour Insurance and all of the big things that are going on, we thought that now was the time to announce that we are rebranding! For over a decade, the Armour brand has used the familiar A emblazoned shield (pictured below). While this logo has been iconic, and served us well, we felt that it did not fully represent who Armour is today.

Old Brand

Topics: Armour Spotlight Armour staff Armour Insurance staff

4 min read

What is Holistic Pet Treatment and How can it Help My Pet?

By Jake McCoy on Aug 30, 2022 2:45:00 AM

August 30 is Holistic Pet Day! In honour of the day, we have partnered with Pet Shield, the official pet insurance provider for Armour Insurance, to let you know a little bit about holistic pet treatments.

Topics: pet insurance Holistic Treatment Pet Shield Holistic Pet Treatments

3 min read

How is inflation impacting insurance?

By Jake McCoy on Aug 15, 2022 4:00:00 PM

Inflation, inflation, inflation. The word that truly feels like the buzzword of 2022. Many consumers have had no claims or infractions in the past 12-24 months, yet they see their insurance rates increase. This is obviously frustrating and annoying. But why is it happening?

Topics: Auto Insurance home insurance Replacement Cost Inflation Automatic Policy Review

8 min read

Road Rage - What's The Cost of Agressive Driving?

By Jake McCoy on Aug 5, 2022 8:45:00 AM

Most people are familiar with the term “road rage” and have an idea of what it means. They would likely associate it with someone swearing and/or yelling at other drivers from their vehicle, honking unnecessarily, or generally driving unsafely out of agitation. This behaviour is actually more in line “aggressive driving”. You might be thinking that those sound interchangeable, but there is an important distinction between them.

Topics: Risk Management safety Car Insurance Car Insurance Edmonton distracted driving UBI Road Rage Aggressive Driving

2 min read

How to get tree sap off of your car

By Jake McCoy on Aug 1, 2022 7:00:00 AM

Tree sap is on of the tougher substances to get off of your car. The sticky golden compound just doesn't seem to want to want to go anywhere. No matter how much you try to force it, no matter what car wash you use, nothing seems to get it off. Today, try this instead.

Topics: car car safety car tips

4 min read

H.E.A.R.T. – What resides at Armours Core?

By Jake McCoy on Jul 28, 2022 10:30:00 AM

The core values of an organization are meant to be the foundation for all decisions made by that business. They are the lens that we use to define culture, influence our behaviour, and how plan to achieve our goals. Many companies have a vague or arbitrary set of core values that the folks at corporate came up. Most of the operations people don’t have the faintest idea of what core values of their company are.

Topics: Culture Armour staff Armour Insurance staff

4 min read

Travel insurance - Why would/should i get it?

By Jake McCoy on Jul 18, 2022 10:13:00 AM

With many Albertans eager to back to travelling, we wanted to give some insight into what travel insurance is, what it covers, how it can help, and what can impact your travel insurance costs.

Topics: travel insurance travelers insurance

2 min read

What is D & O Insurance and why would I need it?

By Jake McCoy on Jul 12, 2022 12:42:00 PM

What is directors and officers insurance?

Directors, officers, and board members are liable for actions of a fiduciary nature. In the event of a lawsuit brought on by:

Topics: commercial insurance Commercial Insurance Alberta Board of Directors

4 min read

Gas Prices got you down? What's the operating cost of an electric vehicle in Alberta?

By Jake McCoy on Jul 8, 2022 10:15:00 AM

With the high cost of fuel, many drivers are considering making the switch to an electric vehicle. How much could you save on your fuel?

Topics: filling up gas savings Edmonton electric vehicle EV Alberta

4 min read

What the heck is hypermiling and can it save me money on gas?

By Jake McCoy on Jun 23, 2022 9:00:00 AM

What is Hypermiling?

Hypermiling is a driving technique that maximizes your vehicles fuel efficiency AKA saving you money on gas. Hypermiling can be done in any vehicle regardless of consumption so you can practice hypermiling in an H2 Hummer or in a Fiat 500. Effective hypermiling can improve fuel economy by nearly 40%.

Topics: filling up gas savings hypermiling

2 min read

The Flaws of Online Insurance

By Gina Schopfer on May 17, 2022 2:25:48 PM

When looking for insurance, taking the online route may seem convenient at first, but there are actually many disadvantages to doing so. In fact, we would say that having a licensed broker find the best options for you makes things much more convenient! Here are our reasons why getting your insurance online may be leaving holes in your coverage AND your levels of service.

1 min read

Our Recent Cyber Insurance Webinar

By Gina Schopfer on Apr 19, 2022 2:01:20 PM

Managed Service and IT Providers have unique exposures when it comes to Cyber Security. The line is still grey when is comes to distinguishing who's responsible for cyber breaches, cyber crimes, mitigating losses, and more importantly, what insurance options are available and best for you. With multi-million dollar payouts happening for cryptolocker incidents, it's important to make that line a little clearer.

1 min read

DCPD Makes a Big Difference in the Cost of Basic Insurance, Especially for Young Drivers!

By Gina Schopfer on Apr 11, 2022 4:27:17 PM

The Direct Compensation for Property Damage (DCPD) system is making a big difference in the the cost of 'basic' insurance, especially for young drivers!

2 min read

Meet Keva, Our Personal Lines Account Manager

By Gina Schopfer on Apr 1, 2022 8:30:28 AM

Here at Armour Insurance, we love to shine a spotlight on our all-star team members, so you can get to know us a bit better. Meet Keva Barker, our Personal Lines Account Manager at our Head Office in Edmonton!

Topics: Armour staff

2 min read

Armour Insurance Day-Off Raffle Proceeds Support WIN House

By Gina Schopfer on Mar 28, 2022 11:19:39 AM

Who doesn't love a day off?!

We at Armour Insurance know how valuable a day off can be, which is why we created the day off raffle! Every year, Armour Insurance sells day off raffle tickets to our staff for $2 each, and offers a total of 12 days off throughout the year. The Armour Team draws someone's ticket each month, and that person gets a day off.

Topics: Armour staff donate

1 min read

Economical Insurance's Recent $5K Winner

By Gina Schopfer on Mar 23, 2022 2:33:03 PM

We are happy to announce that Coral A. has been drawn as the recent winner of Economical Insurance's $5K draw for 2021! Coral recently started a new job that makes a real impact in the community, and we couldn't think of someone more deserving of this prize.

Topics: Economical Insurance

1 min read

How Armour Insurance Measures Up

By Gina Schopfer on Mar 15, 2022 12:11:25 PM

When looking for insurance, your options can seem never-ending. One of the most common ways to determine how a company measures up is by checking out their online reviews, and the business' overall rating based on those reviews. Read on to see how Armour Insurance's rating compares to other insurance companies!

Topics: better service

2 min read

Armour Wins Best of the Best Insurance Provider in Lethbridge!

By Gina Schopfer on Mar 9, 2022 10:29:43 AM

We are thrilled to announce that Armour Insurance has been voted as the "Best of the Best" insurance provider in Lethbridge for 2022! We're very proud of this nomination, and want to give a huge thank you to everyone who voted for us, as well as our customers for allowing us to continue servicing your insurance needs.

2 min read

Armour Celebrates Partnership with Westend Seniors Activity Centre

By Gina Schopfer on Feb 23, 2022 2:12:47 PM

Last Friday, we at Armour Insurance had a great time launching our new group insurance program with Westend Seniors Activity Centre! We celebrated the launch by holding a fun scavenger hunt and bottle drive for WSAC members.

2 min read

How Does Leaving for Vacation Impact My Home Insurance Coverage?

By Gina Schopfer on Feb 8, 2022 5:19:55 PM

Did you know that when you leave for vacation, this may cause an impact on your existing home insurance coverage? Read on to learn how going away might affect your coverages, as well as tips and tricks for making sure you're ready to jet set!

2 min read

Snowmobile Safety Tips

By Rob Stevenson on Jan 21, 2022 1:00:00 AM

Snowmobiling is a thrilling yet risky way to enjoy the great outdoors. Before you turn on the engine, it is wise to learn how to properly operate the mechanical controls and safety devices of the vehicle. It is also important to read the owner’s manual and take a safety course. Don’t let an accident or injury ruin your day – keep your rides scenic and safe with the following safety recommendations.

Topics: safety snowmobile

2 min read

Low-Cost Ways to Increase the Value of Your Home

By Gina Schopfer on Jan 20, 2022 10:15:39 AM

Whether you're looking to sell your home, or enjoy it for yourself, making low-cost home improvements can make a major impact. Before you put your home on the market, we recommend looking into cost-effective ways to bring up your home's value. Here are our budget-friendly home improvement tips:

Topics: home insurance Homeowners home maintenance

1 min read

Catalytic Converter Theft

By Gina Schopfer on Jan 16, 2022 6:51:15 PM

Across Alberta, catalytic converter theft is on the rise. Why is this? There are three metals found inside that are quite valuable: platinum, rhodium, and palladium. As the prices of these metals continue to rise, so do the thefts.

2 min read

Meet Cassandra, Our Personal Lines Account Manager

By Gina Schopfer on Jan 10, 2022 4:22:09 PM

Here at Armour Insurance, we love to shine a spotlight on our all-star team members, so you can get to know us a bit better. High five to Cassandra MacDonald, our Personal Lines Account Manager, who moved across the country in 2021 to join us!

Topics: Armour staff

2 min read

The Armour Team's Holiday Trees

By Gina Schopfer on Dec 24, 2021 8:54:30 AM

Happy Holidays from Armour Insurance!

Here at Armour, many of us are still working from home. To include the entire team in the holiday spirit, we asked everyone to send us pictures of their holiday trees!

2 min read

Armour Supports YESS & SafeGen Through Intact's Better Communities Program

By Gina Schopfer on Dec 16, 2021 4:11:50 PM

Intact Insurance's Better Communities Program provides an opportunity for brokers to apply for a donation to a registered charity that matters to them, and supports one of the mandates to address:

- Child Poverty

- Youth Success

- Mentorship/Leadership

- Education

2 min read

Armour Insurance Named an IBC Top Insurance Employer

By Gina Schopfer on Dec 2, 2021 11:10:18 AM

We're very excited to announce that Armour Insurance has been featured as one of the Insurance Business Canada's Top Insurance Employers this year with an overall average score of 4.58/5! Armour has been celebrated in December's edition of Insurance Business Canada, and announced on their website.

Topics: Culture

2 min read

DCPD is Coming to Alberta

By Gina Schopfer on Nov 10, 2021 3:23:20 PM

On January 1, 2022, Alberta will adopt a Direct Compensation for Property Damage (DCPD) system, which can help improve the way Alberta insurers support their customers in the case of auto collisions taking place in the province. DCPD will form part of the mandatory auto insurance coverage, and will apply to all classes of vehicles in Alberta.

2 min read

Lloydminster's Housing Market

By Gina Schopfer on Nov 5, 2021 4:34:52 PM