Earlier this month, I got a letter from my insurance company about how my property insurance deductibles were being increased from $1,000 to $2,000 on hail damage and water damage. On the one hand, I was happy to hear that my premiums weren’t going up, but on the other hand, I was a little surprised to see that my deductible was literally doubling from last year with no claims or changes to my policy. When I got this news, I did what most people would do, and I gave my broker a call to ask why this happened. They let me know that the insuring company is expecting increased extreme weather activity that will cause property damage. Ultimately, if I had to pick between a higher premium or a higher deductible to account for the risk, I’d rather risk the higher deductible.

This situation made me wonder: How is climate change impacting insurance in Alberta? Alberta isn’t a low-lying territory at risk of ending up underwater, so the change in water coverage wasn’t immediately apparent. That is why today, I decided to do some investigation on how climate change is impacting Alberta insurance.

I wanted to answer two questions:

- How will climate change impact Alberta?

- How will those impacts affect the insurance market?

Without further ado, here are a few answers to those questions we’ve been able to cook up.

How Will Climate Change Impact Alberta?

Climate change looms large over the province, threatening to disrupt ecosystems, economies, and everyday life. As temperatures rise and weather patterns become increasingly erratic, Alberta is witnessing a surge in extreme weather events, including:

- Wildfires

- Hailstorms

- Floods

Forest Fires

Alberta's boreal forests, spanning vast expanses of land, are particularly vulnerable to the ravages of wildfires exacerbated by climate change. Warmer temperatures, prolonged droughts, and drying vegetation create ideal conditions for the ignition and spread of wildfires, posing significant risks to communities, infrastructure, and natural habitats.

Recent years have seen devastating wildfires engulfing large swaths of Alberta, with notable events such as the 2016 Fort McMurray wildfire serving as stark reminders of the destructive power of these infernos. The economic toll of wildfire-related damages, including property loss, infrastructure damage, and firefighting costs, underscores the urgent need for proactive measures to mitigate.

Hailstorms

Alberta's prairie regions are no strangers to the fury of hailstorms, which can wreak havoc on homes, vehicles, and crops. Climate change is exacerbating the intensity and frequency of hailstorms, with warmer temperatures fueling the formation of larger hailstones capable of inflicting substantial damage.

Hailstorms pose significant risks to property owners and insurers alike. From shattered windows to battered roofs, the aftermath of a hailstorm can leave a trail of destruction in its wake, underscoring the importance of robust insurance coverage and resilience planning.

Flooding

Climate change amplifies the risk of flooding through various mechanisms, including increased precipitation, melting snowpacks, and changing hydrological patterns. Warmer temperatures lead to more frequent and intense rainfall events, resulting in elevated river levels, flash floods, and overwhelmed stormwater systems. Additionally, melting glaciers and snowpacks contribute to higher river flows and prolonged flood seasons, exacerbating flood risks in low-lying areas.

These climate-driven changes in precipitation patterns and hydrological dynamics heighten the vulnerability of Alberta's communities to flooding, necessitating proactive measures to mitigate risks and enhance resilience.

How Will the Impacts of Climate Change Affect the Alberta Insurance Market?

We have put together six changes to the insurance market that could be brought on by climate change. They are:

- Greater Investment Into Forecasting

- Discounts for Preventative Care/Upgrades

- Higher Premiums in Certain Regions

- Limited Coverage Options for Extreme Events

- Specialty Markets for Higher Risks

- Increased Deductibles

With these 6 factors, it is important to remember what the goal of insurance is. Insurance is the business of purchasing risk mitigation. Obviously purchasing home insurance would not prevent your house from getting pelted by hail, but it can financially compensate you for the damages.

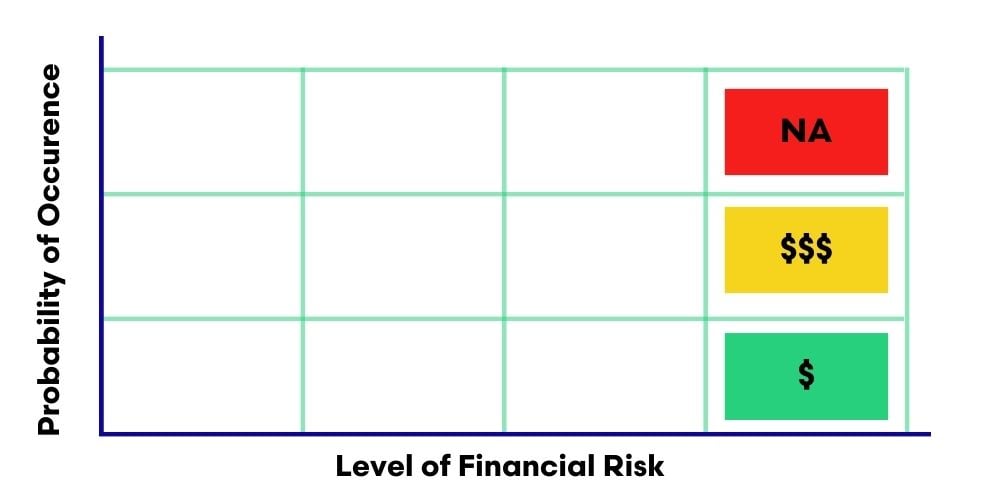

Insurance is primarily to financially protect you from events that are relatively low in probability but would have a high financial impact. As risks from climate change increase the probability of something financially devastating happening, and the cost of that either increases or stays the same, prices will increase.

With climate change increasing the probability of severe financial outcomes, we move from the green square in the above chart to the yellow or even possibly the red square.

Greater Investment Into Forecasting

Disaster forecasting can inform insurers about emerging risks and vulnerabilities, prompting investments in risk mitigation and prevention measures. By identifying areas prone to specific hazards such as floods, hurricanes, or wildfires, insurers can collaborate with governments, municipalities, and community stakeholders to implement infrastructure improvements, zoning regulations, and land-use planning strategies aimed at reducing exposure to natural disasters.

Investing in proactive mitigation measures not only enhances resilience but also reduces the frequency and severity of insurance claims, leading to cost savings for insurers in the long run. It’s easier to predict losses when you have better and more rounded data for potential disasters. Most major insurance companies have already taken steps to improve their ability to forecast disasters.

Discounts for Preventative Care/Upgrades

It is already quite common for insuring companies to offer discounts on policies when a mitigating measure is implemented. There are discounts on home insurance for having a monitored security system, installing sump pumps, and upgrading your home's plumbing.

As climate change increases the risk of certain types of claims, upgrades that mitigate those risks are likely to see discounts. Upgrades like impact-resistant shingles and siding, firebreaks on properties, and backflow prevention systems could lead to discounts on insurance in the future.

Higher Premiums in Certain Regions

As you might expect, when risk goes up for insurance companies, the price also follows suit. A little house on the prairie is going to be at a lower risk of forest fire than a cabin in the woods. If you’re located in a heavily wooded area, your risk of wildfire damage to your home, business, or vehicle is much higher. If you live in southern Alberta, in and around the hail belt, you’re at a higher risk of hail damage. If you live in a low-lying or river-adjacent area, you’re going to be at higher risk of flooding.

Identical homes with identical coverages in different areas could see drastically different premiums depending on the surrounding areas. With disastrous events becoming more common, the price disparity between areas could become very large.

Limited Coverage Options for Extreme Events

While increased premiums are not very fun to deal with, having coverage unavailable at all could be even worse. There are already limited coverage options in the market depending on where you live. There are areas of the province where you cannot purchase protection against water damage due to the high likelihood of occurrence. There could be larger areas where consumers are left without viable coverage options or coverage could become very limited.

Emergence of Specialty Markets for Higher Risks

In the insurance world, there is often a situation of when one door closes another one opens. In this case, some companies may cease to provide coverage in higher-risk areas, which could in turn open opportunities for specialty markets.

Companies like Premier Insurance have been early adopters of accepting unusual or niche risks. They have insurance products for barndominiums, tiny homes, home-based businesses, and many more. As climate change exacerbates extreme weather phenomena, there will likely be specialty markets that arise to take on that risk.

Increased Deductibles

In a bit of a full circle moment, one of the easiest solutions for insurance companies to mitigate the risks of climate change is simply increasing deductibles, just as I saw on my property insurance renewals. Increasing deductibles is a simple and easy way for insurance companies to mitigate risk. It helps maintain the same coverage you already have without increasing the month-to-month premium. An increased deductible in a claims situation is unfortunate, although it will only impact in the event that a claim actually happens.

Conclusion

As climate change continues to reshape Alberta's insurance terrain, it's crucial to ensure your coverage keeps pace. Don't wait for uncertainties to strike—take charge of your protection today. Contact Armour Insurance for a tailored quote, ensuring you receive the best possible coverage available, and safeguarding your future against the unpredictable.