When most people think about home insurance, they picture protection for major events like fire, theft, or flooding. But many home insurance policies also include additional coverages that are often overlooked. Two of the most helpful are Voluntary Medical Payments and Voluntary Property Damage.

4 min read

Voluntary Payments Coverage: Understanding Your Home Insurance

By Jake McCoy on Aug 8, 2025 10:58:47 AM

Topics: home insurance property insurance

4 min read

Additional Living Expenses: Understanding your Home Insurance

By Jake McCoy on Jul 24, 2025 8:30:00 AM

No one expects to be forced out of their home. But disasters like fires, floods, or windstorms can leave your property temporarily uninhabitable. In these moments, the last thing you want to worry about is where you will stay or how you will afford to maintain your standard of living. That is where Additional Living Expenses, often called ALE, come into play. This important part of your property insurance policy helps ease the financial burden when life is disrupted by a covered claim.

Topics: home insurance property insurance Additional Living Expenses

5 min read

Getting a Home Insurance Quote Doesn’t Have to Be a Pain

By Jake McCoy on Jun 17, 2025 7:45:00 AM

Let’s be honest. Getting a home insurance quote doesn’t top anyone’s list of fun things to do. A lot of people assume it’s a long, frustrating process filled with obscure questions and time-consuming forms. While it used to be that way, modern quoting tools and smart data systems have changed the game.

The truth? It’s probably easier than you think. If you’re working with a brokerage like Armour Insurance, we’ll do most of the heavy lifting for you. Let’s walk through how quoting works, why certain questions matter, and how we make it as smooth and painless as possible.

Topics: home insurance property insurance

5 min read

10 Things You Might Want to Name On Your Property Insurance Policy

By Jake McCoy on Mar 24, 2025 8:30:00 AM

Whether you live in a condo, a house, or you’re renting the place you call home, your property insurance is an important part of your financial stability. Regardless of whether you own the place you call home; an important part of your property insurance is ensuring you have adequate coverage for the contents.

Topics: home insurance property insurance Tenants Insurance

3 min read

Contents Coverage: Understanding Your Home Insurance

By Jake McCoy on Mar 21, 2025 9:30:00 AM

Your home is more than just four walls, it’s filled with the possessions that make it uniquely yours. From furniture and electronics to clothing and collectibles, these belongings hold both financial and sentimental value. That’s where contents insurance, also known as personal property coverage, comes in. It helps protect your possessions in case of unexpected events like theft, fire, or water damage.

Topics: home insurance property insurance

2 min read

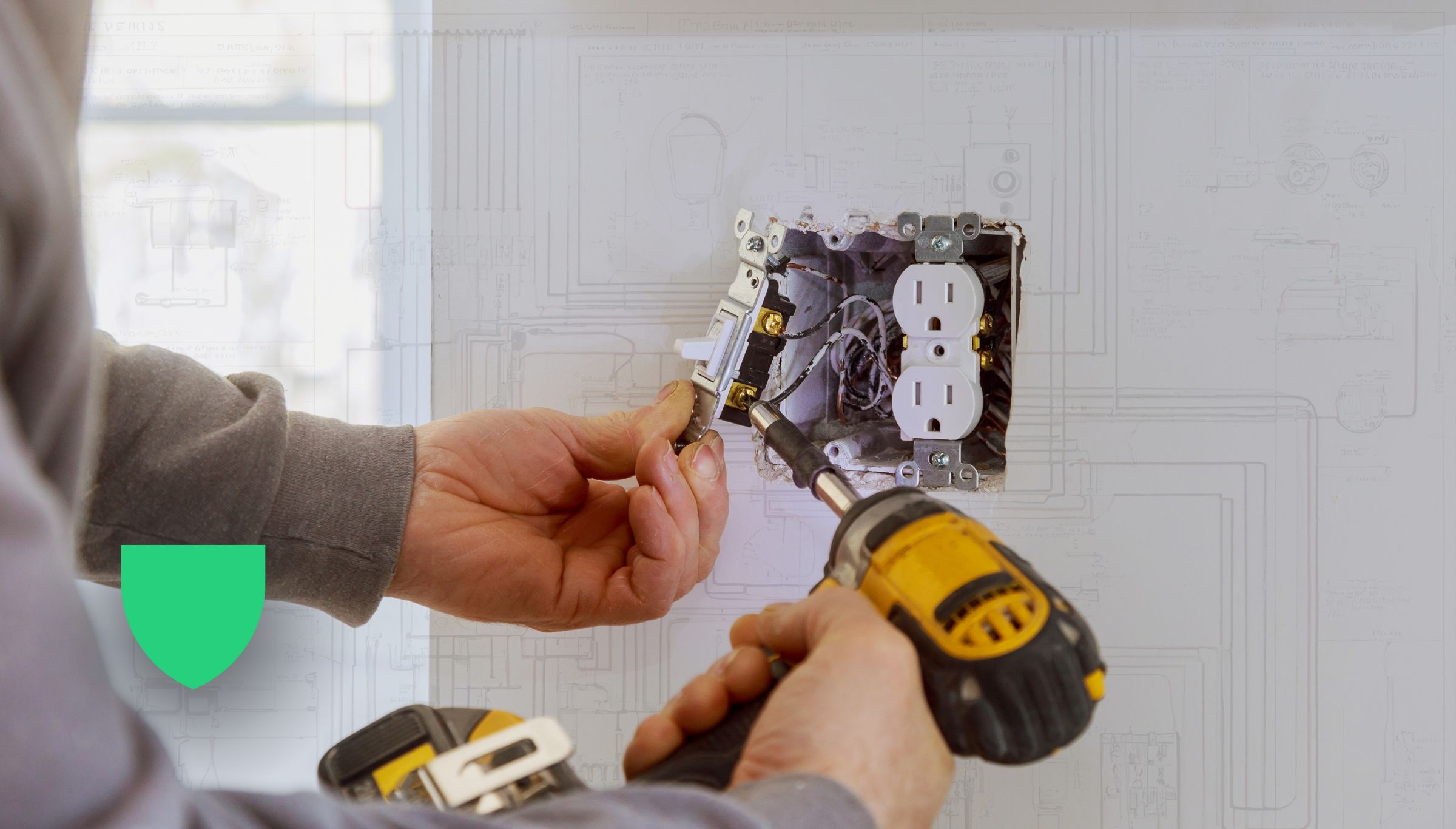

How Do I know What Kind Of Wiring My Home Has?

By Jake McCoy on Mar 11, 2025 1:00:00 AM

Knowing the type of wiring in your home is crucial for safety and insurance purposes. Different types of wiring have different risks associated with them, and understanding what you have can help you make informed decisions about maintenance and coverage. In Canada, homes can have various types of wiring, including aluminum, copper, and knob-and-tube. Here's a simple guide to help you identify what kind of wiring your home uses.

Topics: home insurance property insurance

5 min read

What Does My Property Liability Insurance Cover?

By Jake McCoy on Mar 5, 2025 9:45:00 AM

When you own or rent the place you call home, it is incredibly important to get property insurance. In some cases, you're legally required to have insurance to be able to get a mortgage or sign a lease. Even if you're not technically required to have a property insurance policy, it's still in your best interest to get property insurance that at the very least gives you liability protection.

Topics: property insurance liability third party liability

3 min read

Dwelling Coverage: Understanding Your Home Insurance

By Jake McCoy on Feb 25, 2025 9:30:00 AM

When it comes to protecting your home, having the right insurance coverage is essential. One of the most important components of a homeowners insurance policy is dwelling coverage. But what exactly is dwelling coverage, and why do you need it? Let's break it down.

Topics: home insurance property insurance

3 min read

Outbuilding Coverage for Home Insurance: What You Need to Know

By Jake McCoy on Feb 8, 2025 7:00:00 AM

When most people think of home insurance, they typically think of coverage for the main structure of their home. However, many homes also have additional structures on their property, such as sheds, detached garages, or barns. These structures are commonly referred to as outbuildings, and they can be just as vulnerable to damage or loss as the main house. That's why it's important to understand outbuilding coverage for home insurance. Here is some information to help make sure you have the right protection in place.

Topics: home insurance property insurance

7 min read

How Much is Property Insurance In Alberta? A 2024 Recap

By Jake McCoy on Jan 13, 2025 3:05:12 PM

Owning or renting a property in Alberta brings important responsibilities: Like property insurance. In 2024, Armour Insurance analyzed data on home, condo, and tenant insurance premiums to provide a general picture of property insurance costs in Alberta. By sharing these insights, we aim to help homeowners, condo dwellers, and tenants understand their coverage needs and get a baseline for protecting what matters most.

.jpg)