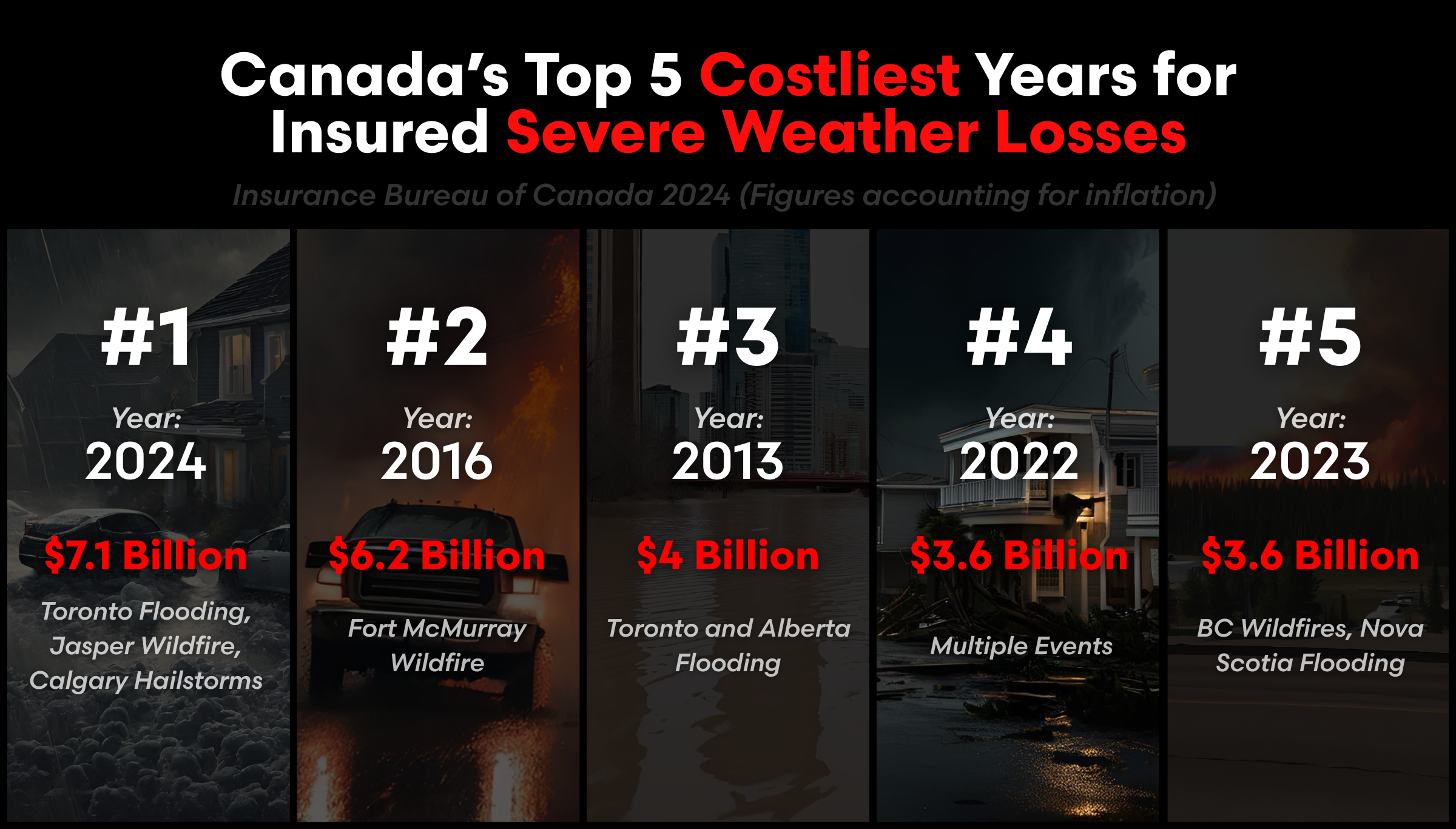

The summer of 2024 has gone down as the most expensive season for insured severe weather losses in Canadian history. With devastating floods, wildfires, and hailstorms, it served as a harsh wake-up call about the growing toll of climate-fueled disasters. For Alberta and the rest of the country, this isn’t just a seasonal anomaly, it’s a signal that the severe weather landscape is changing, fast.

4 min read

The $7B Impact of Canada’s 2024 Severe Weather Events

By Jake McCoy on Apr 30, 2025 10:30:00 AM

Topics: Insurance Claims Climate Change

3 min read

Will Home Insurance Cover It? 5 FAQs of Home Insurance Coverage

By Jake McCoy on Sep 26, 2024 10:17:25 AM

Home insurance can be confusing, especially when it comes to understanding what is and isn’t covered. To help you navigate the complexities, we've compiled answers to the top five frequently asked questions about home insurance coverage. Whether you're wondering about damage to your AC unit or concerns about bed bugs, we’ve got the info you need.

Topics: home insurance property insurance Insurance Claims

2 min read

Economical's Building Inflation Factor is Increasing

By Gina Schopfer on Jul 8, 2021 2:46:19 PM

This July, Economical Insurance will be increasing the commercial building inflation factor for Small and Medium Enterprises (SME), Mid-Market, and Agribusiness customers.

Topics: property insurance Insurance Claims Commercial Insurance rates save money Economical Insurance

2 min read

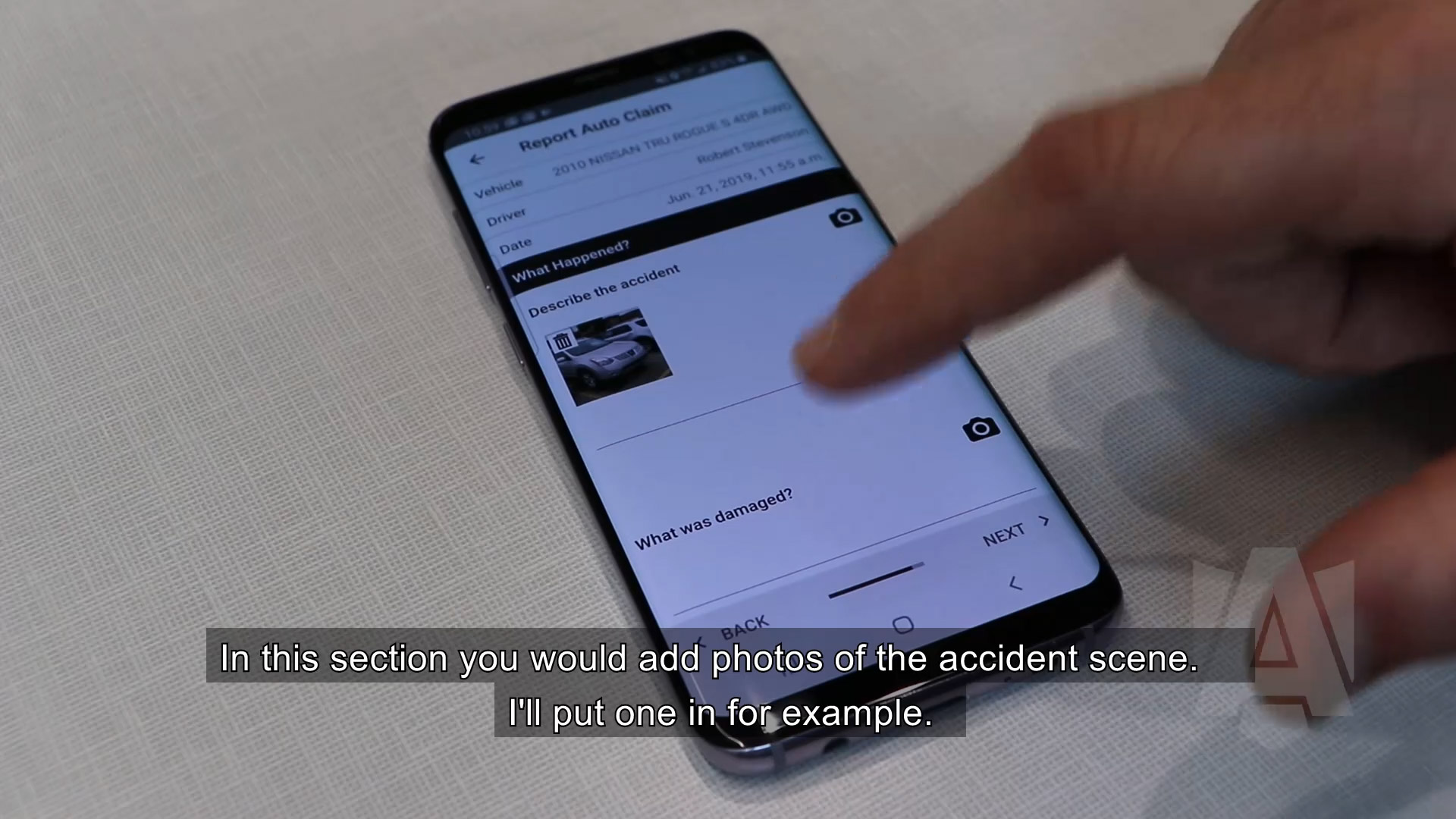

How to Report An Auto Claim on Your Armour Mobile App

By Rob Stevenson on Jul 5, 2019 12:25:00 PM

If you've ever been involved in a collision, you know that no matter how minor, it leaves you shaken. This makes recording all of the information that you need that much harder. Armour makes this process a little bit easier with the Armour Mobile App and our guided claims process.

Topics: Auto Insurance Insurance Claims Insurance Claim

2 min read

Common Mistakes you Don’t Want to Make When Filing Your First Claim

By Rob Stevenson on Jan 25, 2016 10:58:38 AM

The most significant insurance mistake you can ever make is not having any insurance at all. For example, if you drive without auto insurance you are breaking the law. If you get homeowners insurance when you purchase your house and then cancel it, you would be in quite the predicament if a fire destroys your kitchen.

Topics: Car Insurance home insurance Insurance Claims Insurance Claim

1 min read

More Hail Springs Aviva Insurance Into Action

By Rob Stevenson on Aug 12, 2014 3:53:26 PM

In a bulletin released today, Aviva Insurance has stated that the have mobilized their CAT team in Central Alberta. They have dispatched a number of appraisers and set up two drive-in appraisal centres in Airdire in an effort to expedite the appraisals of vehicles damaged in the August 7th hail storm.

Topics: Car Insurance home insurance Insurance Claims Hail Insurance Aviva Insurance

1 min read

Intact Insurance Mobilizes to Handle Hail Claims

By Rob Stevenson on Aug 1, 2014 10:58:00 AM

In a bulletin released Wednesday, Intact Insurance announced that they are mobilizing their team to better handle the large volume of hail claims that have come in over the past few weeks.

Topics: Car Insurance Insurance Claims Hail Insurance intact insurance

3 min read

Intact Insurance Continues to Evolve

By Rob Stevenson on Feb 27, 2014 3:48:00 PM

Saying that it's been a tough couple of years for property owners in our province is a bit of an understatement at this point. In fact, Alberta receives the largest distribution of catastrophes in Canada - 62% of Canada's monetary property losses happened in Alberta in 2012.

Topics: home insurance Insurance Claims house insurance tips home Homeowners intact insurance Economical Insurance

2 min read

Economical Insurance Announces Changes to Alberta Property Insurance Policies

By Rob Stevenson on Feb 12, 2014 10:52:00 AM

Economical Insurance announced some changes to their property insurance policies last week that may seem minor when compared to the reactions to Alberta's severe weather claims that we've seen from other insurance companies. But, while these changes aren't laden with over the top rate increases, they are important for Economical policy holders to review.

Topics: home insurance Insurance Claims house insurance tips home Homeowners Economical Insurance

1 min read

Is Your Home Covered While You're Renovating?

By Rob Stevenson on Jan 7, 2014 8:47:00 AM