Everybody is trying to save some money on their insurance these days. In fact, we often have people calling looking to reduce their coverage to save some money on their annual premiums. While dropping coverages off of your insurance policy can help save you some money in the short run, it could mean that you lose significantly in the event of a claim.

What is PLPD

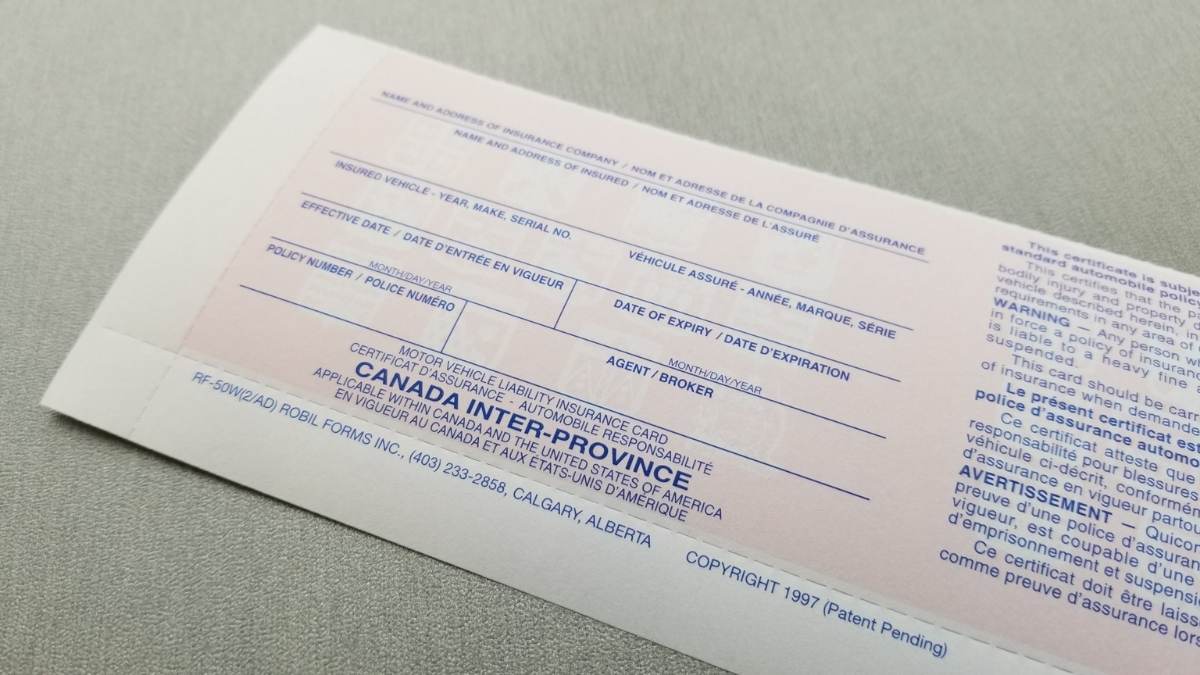

PLPD stands for Public Liability Property Damage. It is the minimum auto insurance coverage required by law in Alberta. The purpose of this coverage is to protect others around you. This will pay for damage to someone else's property as well as any bodily injury they may have sustained due to the accident. It will not pay for damage to your own property. With only this coverage, you will likely be paying for the repair or replacement of your vehicle out of your own pocket.

Removing coverages without understanding the risks could prove to be a big mistake down the road. Your insurance broker is a licensed professional who is trained to understand the inner workings of your insurance policy. Before asking to have coverages removed, always listen to the advice of your insurance broker. It could make all the difference in the world.

If you have questions about your coverages, please give one of our brokers a call today. We'd be happy to help: