Do you often wonder how some of the other drivers on the road ever passed their driver's exam? Are you tired of paying high car insurance premiums caused by all the other bad drivers on our roads? Are you hoping that someday the insurance companies will wise up and give all of us good drivers a break? Well, you may find that your wishes will be granted sooner than you think.

Do you often wonder how some of the other drivers on the road ever passed their driver's exam? Are you tired of paying high car insurance premiums caused by all the other bad drivers on our roads? Are you hoping that someday the insurance companies will wise up and give all of us good drivers a break? Well, you may find that your wishes will be granted sooner than you think.

Usage Based Insurance (UBI) Is Coming to Alberta

Sometimes referred to as Pay as You Drive Insurance or Telematics, Usage Based Insurance has been in use in the UK for years, and is being actively used in Eastern Canada as we speak. Here's how it works.

Your Insurance company provides you with a device that plugs into your vehicle. This device reads real time information from your cars computer as you drive your car. This data is transmitted by the device to the insurance company and after a certain amount of data is collected, you're given a discount on your car insurance premium.

What will the UBI Device Monitor

Unfortunately, there doesn't appear to be any plans to standardize or regulate data capture and interpretation on these devices so each insurance company may monitor different aspects of their customer's driving. Here are some of the areas that could be used to determine your rate:

- Speed

- Acceleration

- Braking

- Driving locations

- Driving times

- Mileage

How Much Money can I Save

We can't say for sure how these programs will work in Alberta, but we can get an idea from one of the Canadian pioneers in telematics, Intact Insurance. They already have these devices on the road in Quebec and they'll be launching Ontario in April.

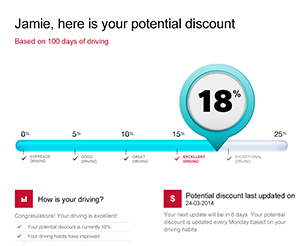

The Intact "My Driving Discount" program in Quebec offers customers a 5% discount just for signing up. After a month of driving data is collected, customers can see up to a 25% discount in their car insurance premiums. This data is all tracked real time and users can see how they're doing through their online dashboard and email notifications.

Will My Rates Go Up If I'm a Bad Driver?

As this new form of insurance rating is introduced, it appears that good driving will be rewarded with discounts and, what is deemed to be, bad driving will simply not be given the discount. Once telematics becomes more widely adopted, it's possible that it could have a negative impact on your rate, but this has yet to be seen.

When Can I Get It

If you're itching to show off your exemplary driving skills to your insurance company in exchange for a discount on your rate, you may not have to wait long. At least one major insurance company is ready to go. All that stands in the way now is a bit of red tape.

If you'd like to be notified when this is available in your community, get on our waiting list and follow us on Facebook and we'll let you know as soon as it becomes available.