Auto insurance customers in Alberta are beginning to see the effects of the industries struggles this month. The AIRB has approved rate increases for insurance companies in Alberta, some of which have gone into effect at the beginning of November. This will leave many consumers wondering what can be done to ensure I'm getting the best value as the entire industry takes on a rate increase. That's where your broker comes in.

As a licensed insurance broker operating in Alberta our priority is to ensure that our customers have to best protection available to them. In fact, at Armour our Core Purpose is "Protecting our policy holders." This means that we always seek out the best coverage AND the best value for each of our customers in each of their own unique situations. And being an Insurance Broker is what makes this possible.

As a licensed insurance broker operating in Alberta our priority is to ensure that our customers have to best protection available to them. In fact, at Armour our Core Purpose is "Protecting our policy holders." This means that we always seek out the best coverage AND the best value for each of our customers in each of their own unique situations. And being an Insurance Broker is what makes this possible.

Because we are an Insurance Broker, we deal with many different insurance companies. We're experts on their rating, risk appetite, policies and future plans. We're on a first name basis with their underwriters and management staff. This allows us to look for better value within our network and eliminates the need for our customers having to shop around.

Automatic Policy Review

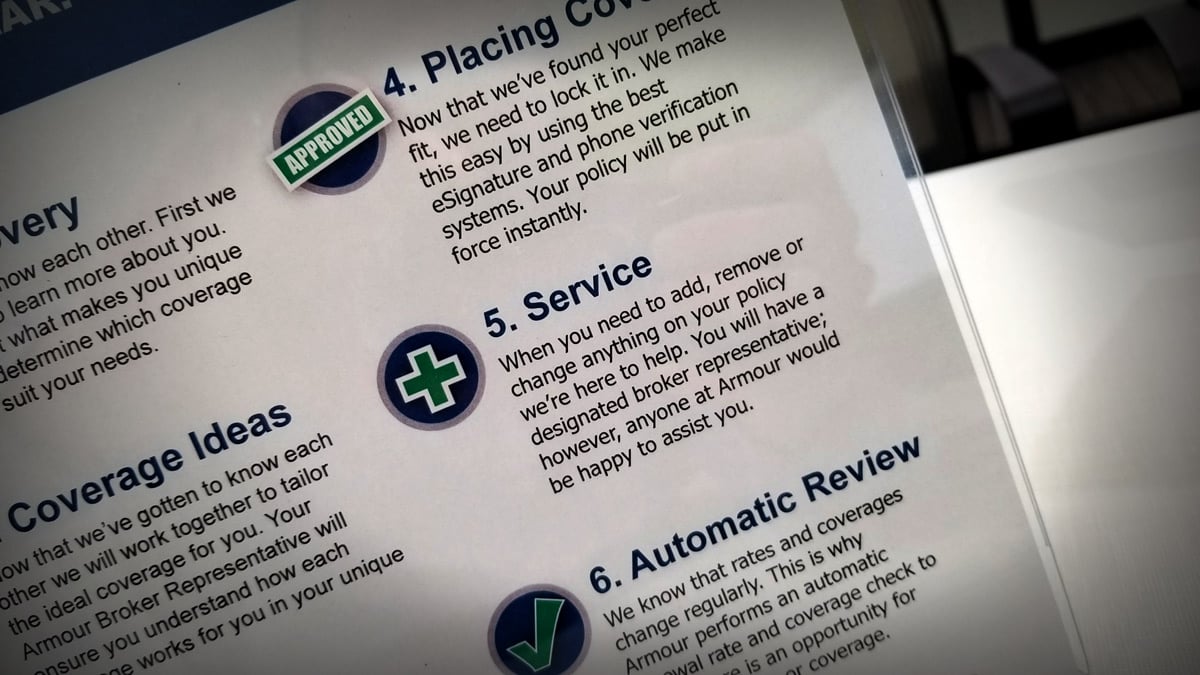

We understand that the customer journey with us does not stop when they purchase a policy. At Armour we operate under, what we call, our "Proven Process". We've built in an Automatic Policy Review into this process. Each policy is automatically reviewed prior to renewal and checked for changes that we believe require further review. One of these changes that trigger a review is larger than average increases in rates. When a large increase is detected, we manually review the file and look for better rates with other insurance companies for you. If we find a better fit, we'll make our recommendation to you and we can take action on it.

We understand that the customer journey with us does not stop when they purchase a policy. At Armour we operate under, what we call, our "Proven Process". We've built in an Automatic Policy Review into this process. Each policy is automatically reviewed prior to renewal and checked for changes that we believe require further review. One of these changes that trigger a review is larger than average increases in rates. When a large increase is detected, we manually review the file and look for better rates with other insurance companies for you. If we find a better fit, we'll make our recommendation to you and we can take action on it.

Often times bouncing around between different insurance providers can affect your rates adversely in the long run, so this is always taken into account. In a market like this, where all insurance companies are increasing premiums across the board it is more important than ever to rely on the advise of your insurance broker. We have a broad understanding of what's happening insurance company rates and coverages. Armour Insurance works very closely with our company partners and we believe this puts us in a much better position to be an advocate and resource for our customers especially in times of need like we will be experiencing this year.

You insurance broker is here for you. If you have more questions please give us a call. For more information on what's happening with Alberta Insurance please see below:

- Global News: Auto insurance premiums going up in 2020 for many Alberta drivers

- Armour Insurance: What to Expect with Insurance Rates This Fall