Your home is more than just four walls, it’s filled with the possessions that make it uniquely yours. From furniture and electronics to clothing and collectibles, these belongings hold both financial and sentimental value. That’s where contents insurance, also known as personal property coverage, comes in. It helps protect your possessions in case of unexpected events like theft, fire, or water damage.

3 min read

Contents Coverage: Understanding Your Home Insurance

By Jake McCoy on Mar 21, 2025 9:30:00 AM

Topics: home insurance property insurance

3 min read

Does My House Have a Sump Pump and/or Backwater Valve?

By Jake McCoy on Mar 20, 2025 6:15:00 PM

Ensuring your home is equipped with essential flood prevention devices like a sump pump and backwater valve can be crucial for protecting your property. In this guide, we'll explain what these devices are, how they work, and how to locate them in your home.

Topics: home insurance Basement Flooding

4 min read

The Guide to Auto Insurance In Alberta: Liability, Comprehensive, and Collision

By Jake McCoy on Mar 11, 2025 10:15:00 AM

Auto insurance is a necessary expense for any vehicle owner. It protects you financially in the event of an accident, theft, or damage to your car. Three levels of coverage are offered to protect your automobile: liability, comprehensive, and collision. Each type of coverage provides different coverages for your vehicle, and it's important to understand the difference between them.

2 min read

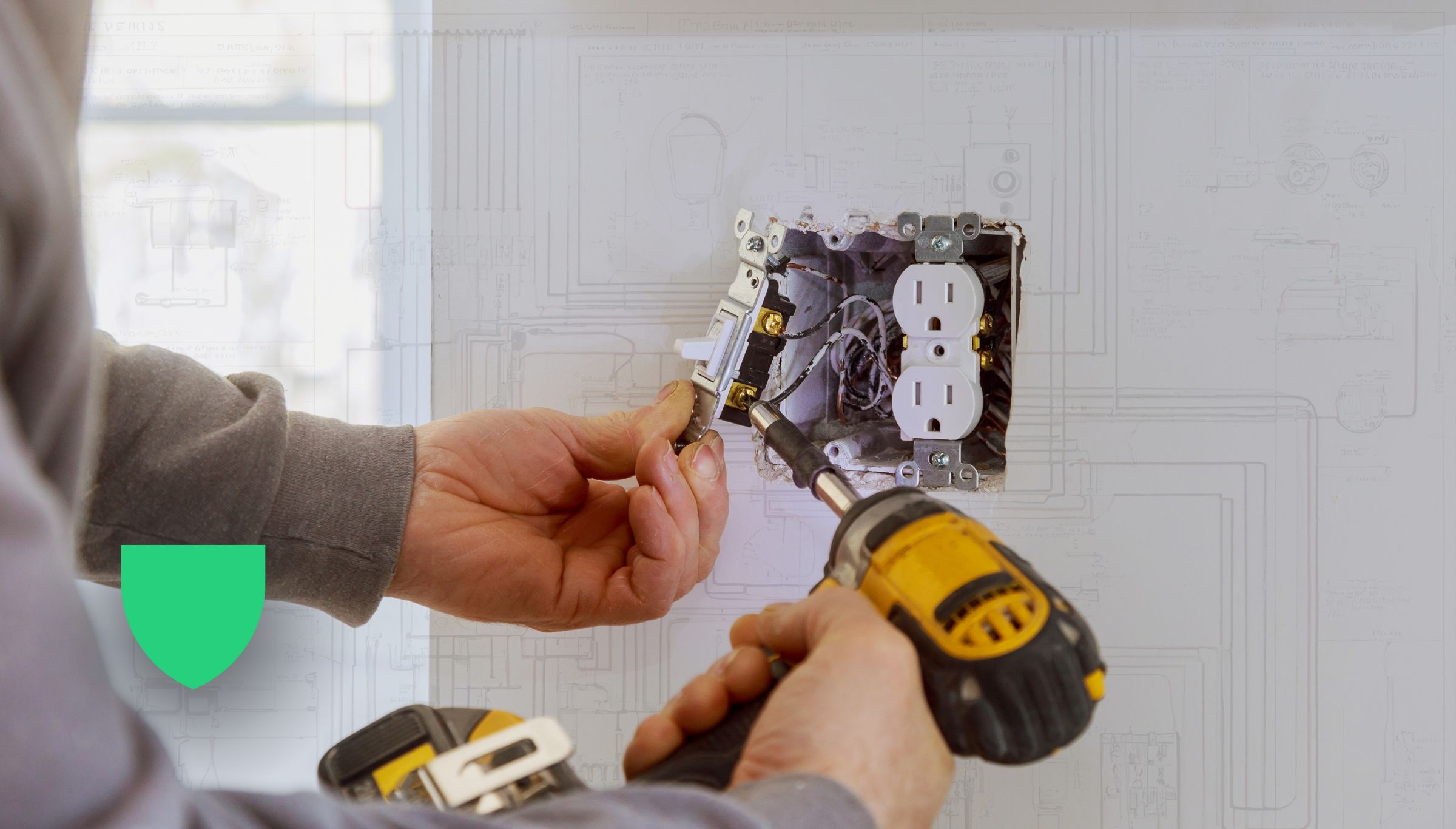

How Do I know What Kind Of Wiring My Home Has?

By Jake McCoy on Mar 11, 2025 1:00:00 AM

Knowing the type of wiring in your home is crucial for safety and insurance purposes. Different types of wiring have different risks associated with them, and understanding what you have can help you make informed decisions about maintenance and coverage. In Canada, homes can have various types of wiring, including aluminum, copper, and knob-and-tube. Here's a simple guide to help you identify what kind of wiring your home uses.

Topics: home insurance property insurance

5 min read

What Does My Property Liability Insurance Cover?

By Jake McCoy on Mar 5, 2025 9:45:00 AM

When you own or rent the place you call home, it is incredibly important to get property insurance. In some cases, you're legally required to have insurance to be able to get a mortgage or sign a lease. Even if you're not technically required to have a property insurance policy, it's still in your best interest to get property insurance that at the very least gives you liability protection.

Topics: property insurance liability third party liability

4 min read

Auto Liability Insurance: What Is It And How Much Do I Need?

By Jake McCoy on Mar 4, 2025 8:30:00 AM

As a driver, it's important to have insurance to protect yourself and others in case of an accident. In Alberta, the legal minimum car insurance is third party liability coverage. In this article, we'll cover what auto liability insurance is, what it covers, whether it's enough, and how much liability insurance you need.

Topics: Auto Insurance Car Insurance Car Insurance Edmonton edmonton car insurance liability third party liability

3 min read

The Implications of Having Your Insurance Cancelled for Non-Payment

By Jake McCoy on Feb 27, 2025 10:45:00 AM

Staying up-to-date on payments is an essential part of protecting yourself and your assets. However, life can throw unexpected challenges our way, and missed insurance payments can happen. As an insurance consumer, it's vital to understand the implications of such situations and what could happen if you're cancelled for non-payment. This short article will breakdown the implications of being cancelled for non-payment and some of the challenges that come with that.

Topics: payments Cancelled for Non-Payment

3 min read

Dwelling Coverage: Understanding Your Home Insurance

By Jake McCoy on Feb 25, 2025 9:30:00 AM

When it comes to protecting your home, having the right insurance coverage is essential. One of the most important components of a homeowners insurance policy is dwelling coverage. But what exactly is dwelling coverage, and why do you need it? Let's break it down.

Topics: home insurance property insurance

4 min read

How to Prevent your Car Battery Freezing in Extreme Cold

By Jake McCoy on Feb 14, 2025 11:45:00 AM

As temperatures plummet to bone-chilling levels, your car becomes more than just a means of transportation—it can be your lifeline in the freezing cold. When temperatures reach the level of "extreme cold" batteries are a common reason for vehicles not starting. Today, we wanted to provide a handful of tips and tricks to help keep your car battery from freezing.

Topics: Car Insurance Car Insurance Edmonton

4 min read

Risk Revealed: Ontario's Top 10 High-Theft Vehicles

By Jake McCoy on Feb 12, 2025 2:00:00 PM

The top 10 most commonly stolen vehicles in Ontario have been released by Canadian company Équité. We wanted to do an in-depth look at vehicle theft frequency, rather than sheer numbers. In essence, we wanted to answer the question, what type of vehicle is most likely to be stolen if you were going to purchase one? The following numbers are based on the rate at which a specific vehicle is stolen proportional to the number of vehicles on the road.