Throughout the year, we'll shine our spotlight on a member of the Armour Team. We're starting March off with one of our newest members of the team: Corey Potter!

2 min read

Armour Spotlight: Corey Potter

By Gina Schopfer on Mar 12, 2021 2:00:00 PM

Topics: broker Armour Spotlight Armour Insurance staff

3 min read

Busting 5 Common Home Insurance Myths

By Economical Insurance on Mar 9, 2021 4:23:45 PM

When you're shopping for home insurance, you'll probably come across a lot of helpful (and, let's face it, not so helpful) information — but how much of it is actually true? Let's break down five of the most common myths about home insurance.

Topics: home insurance property insurance home featured

3 min read

SGI Adds Restrictions to Condo Policies

By Gina Schopfer on Mar 5, 2021 1:12:19 PM

SGI has introduced new coverage requirements for condo policy holders. Effective March 1, 2021, SGI requires that a client's condominium corporation maintains adequate condo insurance for the building itself. This is in effect for all new policies, and could affect existing policy holders with coverage limitations. With current market conditions, this could also become a reality for other insurance companies.

Topics: SGI Canada Condo Insurance Home Systems Protection Service Line Coverage

2 min read

The Future of Life Insurance

By Gina Schopfer on Feb 24, 2021 2:27:46 PM

Insurance should be more than protecting your loved ones; it’s about living your life to the fullest. Manulife Vitality gives you insurance, plus the opportunity to earn rewards and save on how much you pay – all while improving your health.

How does Manulife Vitality work? You track your everyday healthy activities through a customized, goal-oriented program that helps motivate and encourage healthier choices. Before you know it, you'll start earning rewards! You can earn Vitality Points for routine activities like walking, going to the dentist, reading health articles, and more.

Once you start earning Vitality Points, your Vitality Status can move to Bronze, Silver, Gold, then Platinum. Your Vitality Status determines your eligibility for rewards AND a potential discount on your annual cost of insurance. You can work towards improving your health while earning additional perks!

3 Steps to Manulife Vitality:

- Know your Health: When starting the Manulife Vitality program, you'll discover your Vitality age. This might be higher or lower depending on your current overall health. The first step of improving your health is knowing your starting point.

- Improve your health: Track your everyday healthy activities through a customized, goal-oriented program to encourage and inspire healthier choices. The Manulife Vitality program offers simple tips and convenient easy-to-use tools such as wearable devices to help track your activities.

- Enjoy the results: Start earning Vitality Points for routine activities you may already be doing – walking, going to the dentist and reading health articles online. The more points you earn, the higher your Vitality Status, and the greater your potential rewards and discounts.

What are users saying about Manulife Vitality?

For more information, visit Manulife's Vitality for Individuals page. You can also check out Manulife's Program Rewards page that lists the partners involved and your possible rewards. Staying motivated and incorporating a healthy routine can be challenging – Manulife Vitality is here to make it that much easier.

Topics: life insurance health Video Manulife insurance app

1 min read

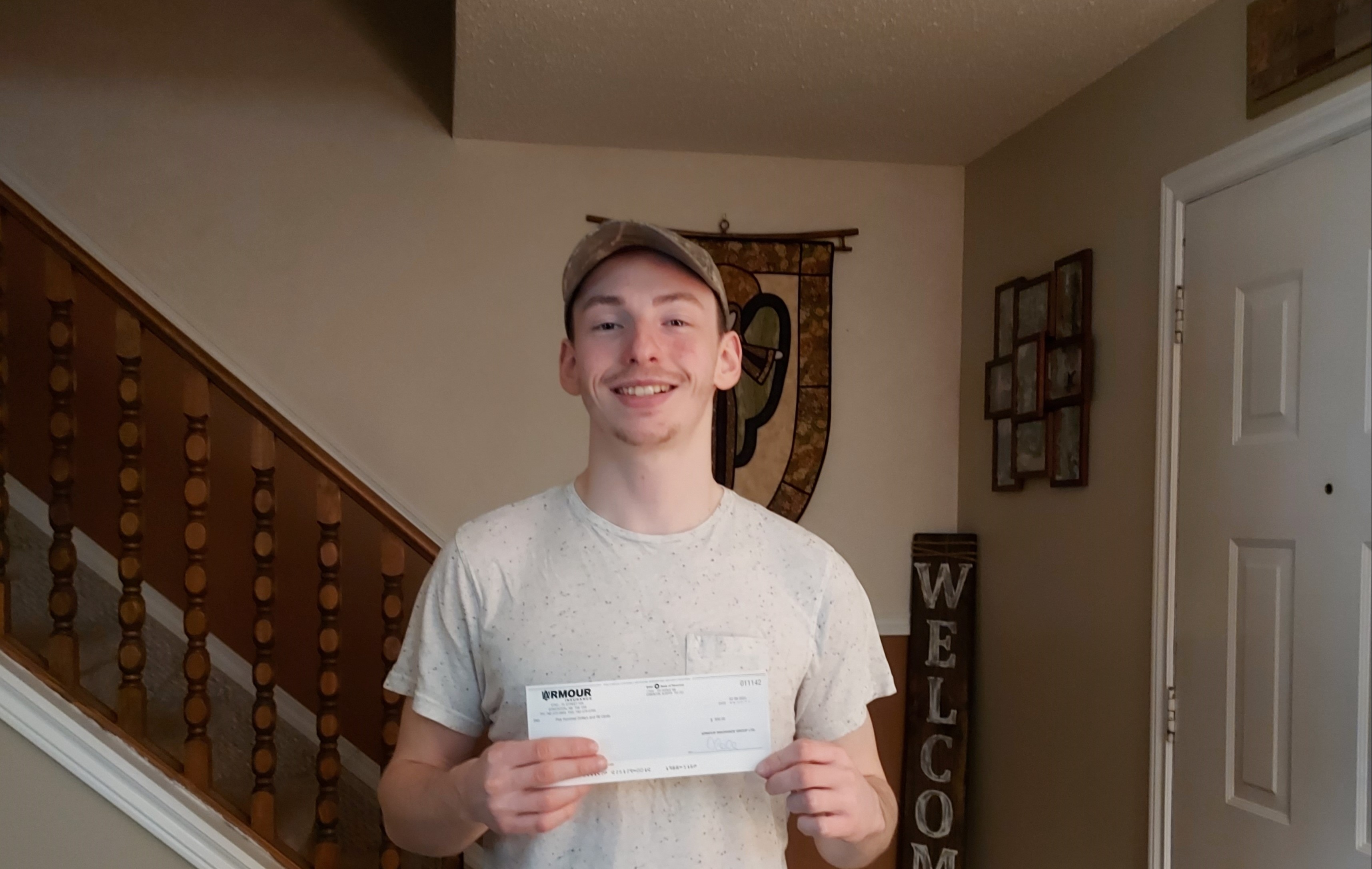

$500 Intact Client Centre Contest Winner!

By Gina Schopfer on Feb 17, 2021 2:00:00 PM

Over recent years, we've witnessed exciting new advances in the insurance industry that have contributed to new services and greater connectivity for our customers. For our Intact customers, one of these is the Intact Client Centre app.

Topics: contestwinner Intact Intact contest winner Intact app

3 min read

Armour Spotlight: Travis Vanberg

By Gina Schopfer on Feb 8, 2021 1:30:00 PM

Throughout the year, we'll shine our spotlight on a member of the Armour Team. This month's pick is none other than Commercial Insurance Broker, Travis Vanberg!

9 min read

What the Latest Rate Board Filing Decisions Mean for Alberta Drivers

By Rob Stevenson on Jan 13, 2021 3:27:08 PM

The Alberta Auto Insurance Rate Board (AIRB) is the organization charged with regulating auto insurance premiums in Alberta. Each quarter insurance companies can file requests asking for changes to their rates. The AIRB reviews these requests and approves or deny's them based on "actuarial justification and the insurer’s individual circumstances to ensure insurance is accessible, equitable and sustainable for all Albertans". The decisions have just been released for last quarters filings. Here's what these mean to Alberta motorists.

Topics: Auto Insurance Commercial Insurance rates Insurance Premiums

1 min read

Aviva Canada Goes Paperless

By Rob Stevenson on Jan 11, 2021 10:05:51 AM

Aviva Insurance has recently announced that it will be moving towards a more paperless experience for their personal insurance customers. In an industry that has traditionally high paper consumption this is welcome news for forests across Canada.

1 min read

Appointment Required for Visits to Armour Offices

By Rob Stevenson on Nov 26, 2020 4:43:03 PM

In compliance with the new mandatory public health measures put in place by the Alberta Government this week Armour Insurance will be offering in person visits to our offices by appointment only for the time being. Our staff remains at full capacity and is available to provide all of our services over the phone and online.

Topics: covid-19

2 min read

The Better Your Credit, The Better Your Rate

By Rob Stevenson on Nov 24, 2020 2:04:23 PM

Banks have been using credit scores for years to give lower rates, special offers and other promotions. Over the last number of years insurance companies are following suit. Now, your good credit can save you real money on your auto and home insurance. We can perform a soft credit check for you and save you up to 20% and offer you a monthly payment plan!