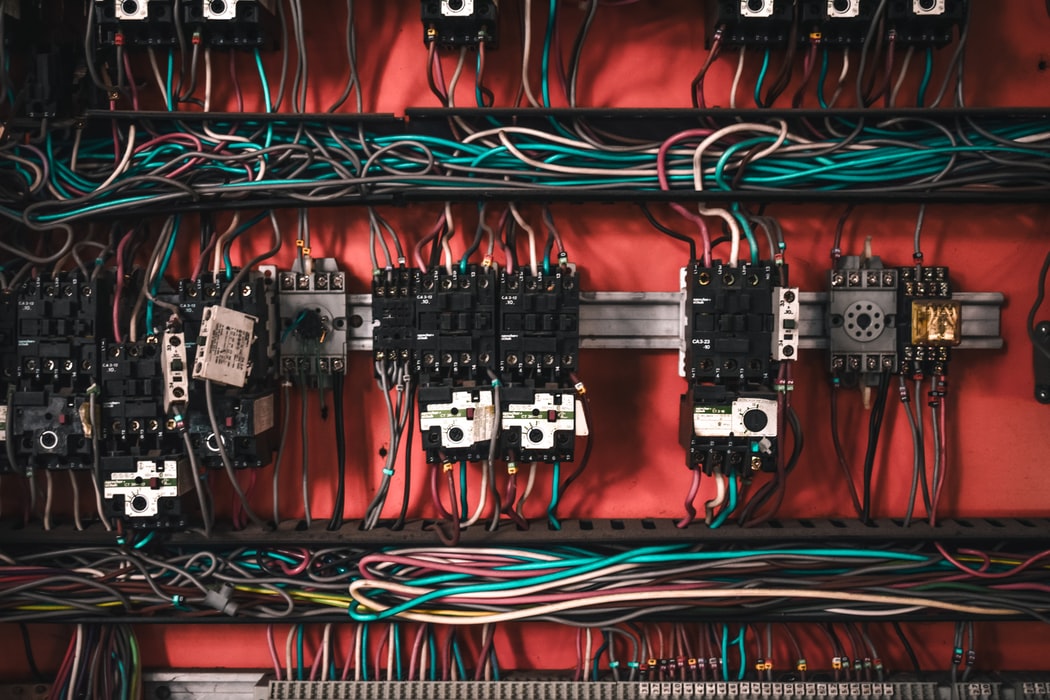

Does your home have aluminum wiring?

Aluminum wiring was commonly used during the 1960s-70s. The price of copper had skyrocketed at the time, and aluminum seemed like the perfect alternative to conduct electricity. Since then, studies have determined that it's much more likely to cause a fire. There are a few reasons for this: